Working capital management is concerned with the problem that arises in attempting to manage the current assets, the current liabilities and the inter-relationship that exist between them. The goal of working capital management is to manage a firm’s current assets and current liabilities in such a way that a satisfactory level of working capital is maintained.

The financial manager must keep in mind the following principles of working capital management:

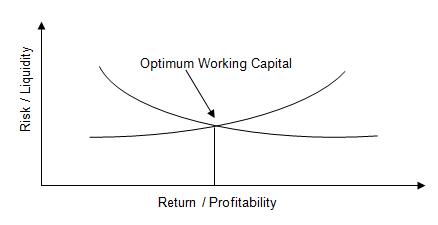

- Principle of Optimization:The level of working capital must be so kept that the rate of return on investment is optimized. In other words, the working capital should be maintained at an optimum level.