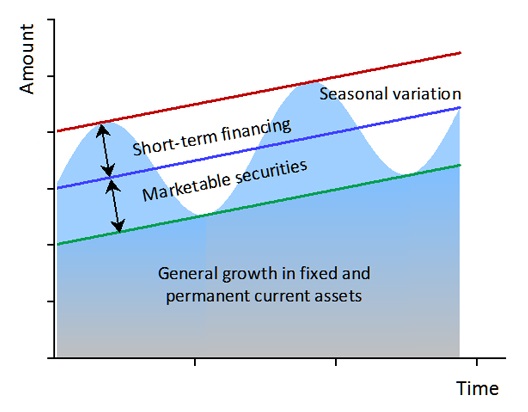

The excess of the amount of working capital over permanent working capital is known as variable or short-term working capital. The amount of such working capital keeps on fluctuating from time to time on the basis of business activities. It may again be sub-divided into seasonal and special working capital. Seasonal working capital is required to meet the seasonal demands of busy periods occurring at stated intervals. On the other hand, special working capital is required to meet extra-ordinary needs for contingencies.

The main sources of short-term working capital are as follows:

1. Indigenous BankersPrivate moneylenders and other country bankers used to be the only source of finance prior to the establishment of commercial banks.… Read the rest