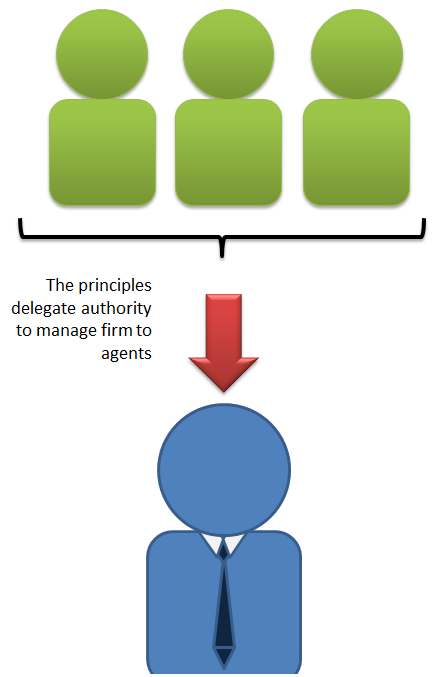

Agency theory is often described in terms of the relationships between the various interested parties in the firm. The agency theory examines the duties and conflicts that occur between parties who have an agency relationship. Agency relationships occur when one party, the principal, employs another party, called the agent, to perform a task on their behalf. Agency theory is helpful in explaining the actions of the various interest groups in the corporate governance debate. For example, managers can be seen as the agents of shareholders, employees as the agents of managers, managers and shareholders as the agents of long and short-term creditors, etc. In most of these principal-agent relationships conflicts of interest is seen to exist. It has been widely observed that the conflicts between shareholders and managers and in a similar way the objectives of employees and managers may be in conflict. Although the actions of all the partiesContinue reading

Financial Management

Financial management entails planning for the future of a person or a business enterprise to ensure a positive cash flow, including the administration and maintenance of financial assets. The primary concern of financial management is the assessment rather than the techniques of financial quantification. Some experts refer to financial management as the science of money management. The five basic components of the Financial Management Framework are: Planning and Analysis, Asset and Liability Management, Reporting, Transaction Processing and Control.

Importance of Profit and Loss Account

The Profit and Loss Account is a Financial Statement which summarizes a company’s revenue and expenditure for a specific period of time, usually prepared annually or quarterly. These statements provide information that shows the ability of a company to generate profits by increasing its revenues and reducing costs. The Profit and Loss Account is also known as a “Statement of Profit and Loss”, an “Income Statement” or an “Income and Expense Statement”. Importance of Profit and Loss Account Profit and Loss Account represents a company’s ability to generate income through their business operations. Many times businesses will need financing to help create the facilities for their operations. Smaller companies usually obtain bank loans that are based on the amount of income a company has earned from past operations. Solid Profit and Loss history is essential for getting the best loan terms. Profit and loss statements are important also because manyContinue reading

The Pros and Cons of Securitization

Securitization forces banks to compete with institutional investors and other financial institutions for the business of prime borrowers. In response, banks are beginning to provide borrowers with a range of fee-earning services that facilitate the sale of debt instruments to investors. For example, banks offer borrowers note-issuing or underwriting facilities instead of loans and agree to help borrowers sell their debt instruments to investors as and when needed. Banks may also agree to purchase only the unsold portion of the debt issue. Thus, securitization is moving banks away from performing traditional banking functions, such as extending credit in exchange for periodic interest payments. In addition, securitization provides the creditor with two significant benefits. Because the lender can choose whether to trade the notes or to hold them to maturity, the lender can better manage its credit limits and asset portfolio. The bank also earns a major part of its incomeContinue reading

Differences Between Value Chain Analysis and Traditional Management Accounting

The Limitations of Traditional Management Accounting There exist five major limitation for traditional management accounting. The first one is the traditional management accounting may treat the firm as a single part. It only provided information for a single enterprise management decision and control, ignoring the external environment and other relevant information also can reflect the firm’s position in the market. Second, the traditional management accounting limited to the collection and analysis of internal financial information, the information break away from the requirements of corporate strategic management and weakened the role of management accounting. Third, the concept of traditional management accounting just focus on solving the relevant and individual internal issues. It can not form a sound management system with the market and long-term interests, so that the composition of the budget system just only concentrate on the enterprise’s internal planning and operations. The forth is the traditional management accounting adoptedContinue reading

Types of Interest Rate Risk

Due to the very nature of its business, a bank should accept interest rate risk not by chance but by choice and when the bank has to take a risk as a choice, then it should ensure that the risk taken is firstly manageable and secondly it does not get transformed into yet another undesirable risk. As stated earlier, the focal point in managing any risk will be to understand the nature of the risk. This is especially essential for interest rate risk management. Interest rate risk is the gain/loss that arises due to sensitivity of the interest income/interest expenditure or values of assets/liabilities to the interest rate fluctuations. Types of Interest Rate Risks The sensitivity to interest rate fluctuations will arise due to the mixed affect of a host of other risks that comprise the interest rate risk. These risks when segregated fall into the following categories. RateContinue reading

Bank Decisions on Investment Borrowings

Assessment of the liquidity gap based on the forecasts is essentially one aspect of the liquidity management. The other major task of liquidity management is to manage this liquidity gap by adjusting the residual surplus/deficit balances. Considering the high costs associated with cash forecasting, it is essential that the benefits drawn by the bank from such forecasting should be substantially large to give some residual gains after meeting the forecasting costs. This objective can, however, be attained only if the bank makes prudent investment/borrowing decisions to manage the surplus/deficit. There are, however, a few factors which must be considered before deciding on the deployment of excess funds/borrowings for meeting the deficit which are given below: Deposit Withdrawals Credit Accommodation Profit fluctuation The liquidity level to be maintained by a bank should firstly, provide for deposits withdrawals and secondly to accommodate the increase in credit demands. While deposit withdrawals must beContinue reading