From the company’s point of view, public deposits are a major source of finance to meet the working capital needs. Due to the credit squeeze imposed by the Reserve Bank of India on bank loans to the corporate sector during 1970s – 1980s and also due to the recommendations of the Tandon Committee, restricting credit, many companies were not getting as much money in the 1980s as they used to get, in the past, from the banks. So, public deposits came handy as working capital fund for businesses. While to the depositor, the interest rate offered is higher than that offered by banks, the cost of deposits to the company is less than the cost of borrowings from bank.… Read the rest

Business Finance Terms

Capital Sources for Business: Equity Shares

Equity shares are financial instruments to raise equity capital. The equity share capital is the backbone of any company’s financial structure. Equity capital represents ownership capital. Equity shareholders collectively own the company. They enjoy the reward of ownership and bear the risk of ownership. The equity share capital is also termed as the venture capital on account of the risk involved in it. The equity shareholders’ liability, unlike the liability of the owner in a proprietary concern and the partners in a partnership concern, is limited to their capital subscription and contribution.

In India, under the Companies Act 1956, shares which are not preference shares are called equity shares.… Read the rest

Process Costing – Definition, Steps and Charactristics

In accounting, process costing is a method of assigning production costs to units of output. In process costing systems, production costs are not traced to individual units of output. Costs are assigned first to production departments and then to units of output as they move through the departments. The process costing method is typically used for processes that produce large quantities of homogeneous products.

The process costing method is in contrast to other costing methods, such as product costing, job costing, or operation costing systems. Using the process costing method is optimal under certain conditions. If the output products are homogeneous, that is, the units of output are relatively indistinguishable from one another, it may be beneficial to use process costing.… Read the rest

Sources of Finance – Financing a New Business

In case of proprietorship business, the individual proprietor generally invests his own savings to start with, and may borrow money on his personal security or the security of his assets from others. Similarly, the capital of a partnership firm consists partly of funds contributed by the partners and partly of borrowed funds. But the company from of organization enables the promoters to raise necessary funds from the public who may contribute capital and become members (share holders) of the company. In course of its business, the company can raise loans directly from banks and financial institutions or by issue of securities (debentures) to the public.… Read the rest

What is Investment ? – Concept, Definition and Features

Man, it is said, lives on hope. But, hope is only a necessary condition for life, but not sufficient. There are many other materialistic things that he needs – food, clothing, shelter, etc. And, like his hope, his needs too keep changing through his life. To make things more uncertain, his ability to fulfill the needs too changes significantly. When his current ability (current income) to fulfill his needs exceeds his current needs (current expenditure), he saves the excess. The savings may be buried in the backyard, or hidden under a mattress. Or, he may feel that it is better to give up the current possession of these savings for a future larger amount of money that can be used for consumption in future.… Read the rest

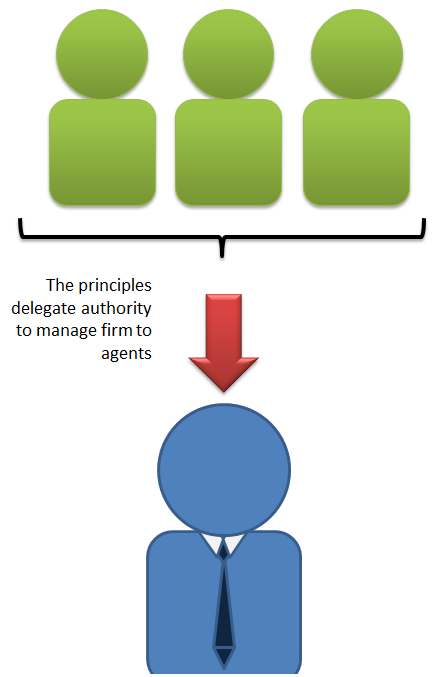

Agency Theory in Financial Management

Agency theory is often described in terms of the relationships between the various interested parties in the firm. The agency theory examines the duties and conflicts that occur between parties who have an agency relationship. Agency relationships occur when one party, the principal, employs another party, called the agent, to perform a task on their behalf. Agency theory is helpful in explaining the actions of the various interest groups in the corporate governance debate. For example, managers can be seen as the agents of shareholders, employees as the agents of managers, managers and shareholders as the agents of long and short-term creditors, etc.… Read the rest