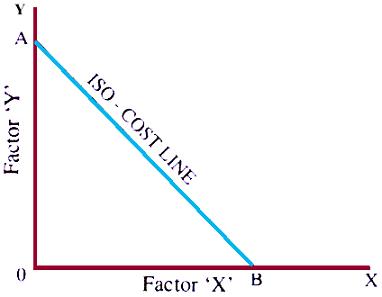

Given the Isoproduct map, the producer would like to ride on the highest possible Isoquant because any point on it would yield maximum possible output. But the producer’s desires are limited by his budgetary constraints. Before he selects a certain combination of inputs he has to take into consideration the size of his investment outlay and the prices of the factors of production. The Isocost Line Let us assume that the investment fund is given and the prices of factors X and Y are also known. On the basis of these assumptions let us suppose that the firm were to spend the entire amount on employing units of only input X. Then it could hireOB units of factor X. On Continue reading

Economics Principles

Isoquants or Equal Product Curves

Isoquant literally means equal quantity or the same amount of output. The Isoquant is a locus of points showing that different combinations of factor-inputs give the same quantity of output. The Isoquant is also called Equal Product Curve. Let us consider an Isoquant schedule. An Isoquant schedule shows that different combinations of factor inputs give same quantity of output. Factor Combination Units of Factor X Units of Factor Y Quantity of Output A 1 9 20 units B 2 6 20 units C 3 4 20 units D 4 3 20 units Let us plot the graph with factor X shown on the X-axis and factor Y on the Y-axis. Plotting the factor combinations; viz. points A, B, C and Continue reading

Marginal Cost Pricing

In case of Marginal Cost Pricing we have to consider the incremental cost of production. Fixed cost is not taken into consideration. Marginal cost is the additional cost for producing additional unit of output. In this method the price is related to marginal cost. The main difference between Full Cost Pricing and Marginal Cost Pricing is that in Marginal Cost Pricing the fixed cost component is not included. The Marginal Cost Pricing is useful in the short period whereas Full Cost Pricing is mainly for the long period. As long as the marginal cost is covered there is a sort of guarantee that the firm will not shut down. Advantages of Marginal Cost Pricing Variable cost remains constant per unit Continue reading

Selling Cost in Monopolistic Competition

Selling costs refer to those expenses which are incurred for popularizing the differentiated product and increasing the demand for it. Selling cost is a special feature of monopolistic competition. Under perfect competition due to homogeneous product and under monopoly because of absence of substitute, the selling costs become unnecessary. The most important instrument by which a firm can convince its buyers about the differentiating nature of its product is advertising. Such expenditure which is incurred by a firm under monopolistic competition to persuade customers to prefer its product to that of its rivals is known as ‘selling costs’. According to famous American economist, Edward Chamberlin, Selling Costs are Costs incurred in order to alter the position Continue reading

Dumping Concept in Managerial Economics

The term Dumping means selling a firms product in foreign market at a price lower than in the home market. Dumping is a form of price discrimination. Let us elaborate ‘dumping’ by considering the following illustrations : Suppose the producer is selling in two markets; viz, the home market and the world market. In the home market he is saddled as a monopolist but in the world market there is perfect competition. Let us therefore analyse the price-output policy of the producer under this peculiar situation. Since there is perfect competition in the world market, the producer has to take the price which prevails in the world market. This is represented by the horizontal average revenue curve Continue reading

Oligopolistic Market

An oligopoly is defined as a market structure wherein industries are dominated or handled by “few” firms. Oligopolistic market structure dominates the market structures available, accounting half of the total outputs in the world. Industries which adapt to these vary from manufacturers of automobiles to breakfast cereal or even television broadcasting to airlines. In the words of Robert Y. Awh, “Oligopoly is that market structure in which a few sellers who clearly recognize their mutual interdependence produce the bulk of the market output”. Oligopoly differs from other market categories in that, under monopoly we have only one seller, under perfect competition we have many sellers, under monopolistic competition we has a sufficiently large group of small monopolists whereas under Continue reading