Cash management is the process of forecasting, collecting, disbursing, investing, and planning for cash a company needs to operate smoothly. Cash management is a vital task because it is the most important yet least productive asset that a small business owns. A business must have enough cash to meet its obligations or it will be declared bankrupt. Creditors, employees and lenders expect to be paid on time and cash is the required medium of exchange. However, some firm retain an excessive amount of cash to meet any unexpected circumstances that might arise. These dormant cash have an income-earning potential that owners are ignoring and this restricts a firm’s growth and lowers its profitability.… Read the rest

Financial Concepts

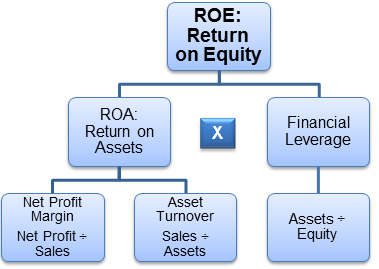

DuPont Analysis – Return on Equity (ROE) Analysis

Financial statement analysis is employed for a variety of reasons. Outside investors are seeking information as to the long run viability of a business and its prospects for providing an adequate return in consideration of the risks being taken. Creditors desire to know whether a potential borrower or customer can service loans being made. Internal analysts and management utilize financial statement analysis as a means to monitor the outcome of policy decisions, predict future performance targets, develop investment strategies, and assess capital needs. As the role of the credit manager is expanded cross-functionally, he or she may be required to answer the call to conduct financial statement analysis under any of these circumstances.… Read the rest

Hedging with Derivatives – Futures Hedging, Forwards Hedging, and Swap Hedging

A futures contract compels the buyer to purchase a particular quantity of assets within a certain period of time. The price of the purchase is agreed in the contract at the time of entering this contract. The asset that is to be purchased is referred to as the underlying asset and the time when this asset is purchased or sold is known as the expiry date or maturity date. While the major difference between a futures contract from an options contract is the obligation to purchase an asset, forward contracts also oblige the buyer to purchase the underlying asset.… Read the rest

Total Return Swaps (TRS)

Total Return Swaps (TRS), sometimes known as a total rate of return swaps or TR swaps, are an on off-balance sheet transaction for the party who pays total returns composed of capital gains or losses plus the ordinary coupon or dividend, and receives LIBOR plus spread related to the counterparty’s credit riskiness on a given notional principal. The bank paying total returns is effectively warehousing, renting out its balance sheet while transferring economic value and risk to preferably an uncorrelated counterparty to the referenced assets. A TRS is similar to a plain vanilla swap except the deal is structured such that the total return (cash flows plus capital appreciation/depreciation) is exchanged, rather than just the cash flows. … Read the rest

Future Flow Securitization

Securitization of the future flow-backed receivables is a new phenomenon in developing economies. Future Flow Securitization has grown in emerging markets in response to finding lower cost funding instrument by investment grade firms in the emerging market economies where their abilities were hampered by sovereign rate ceiling. While many of these companies historically relied on bank loans, or straight debts syndicated by major foreign banks in the past, rising volatility of interest rates and foreign exchange rates as well as reduced risk tolerance of major lenders have pushed these institutions (sovereign and private companies) toward an alternative vehicle such as future flow securitization.… Read the rest

Catastrophe Bonds or CAT Bonds

Catastrophe Bonds (or CAT Bonds) are high-yield, risk-linked securities used to transfer explicitly to the capital markets major catastrophe exposures such as low probability disastrous losses due to hurricanes and earthquakes. It has a special condition that states that if the issuer (Insurance or Reinsurance Company) suffers a particular predefined catastrophe loss, then payment of interest and/or repayment of principal is either deferred or completely waived. These bonds were first introduced as a solution to problems resulting from traditional insurance market capacity constraints, excessive insurance premia, and insolvency risk due to catastrophic losses.

… Read the restCatastrophe Bonds or CAT Bonds are complex financial tools which transfer peril specific risks to the capital markets instead of an insurance company.