An option is a contract, which gives the buyer the right to buy or sell foreign currency at a specific price, on or before a specific date. For this, the buyer has to pay to the seller some money, which is called as premium. There is no obligation on the buyer to complete the transaction if the price is not favorable to him.

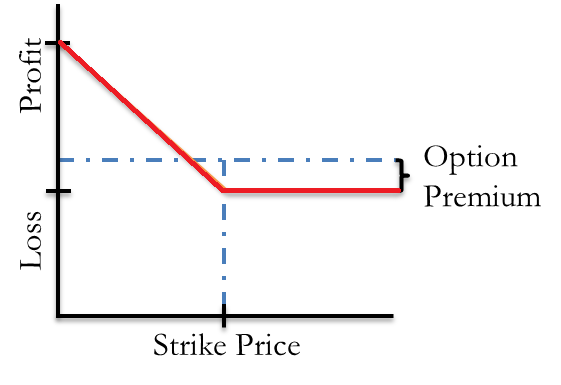

Whenever a person has an intention to sell foreign currency by paying a premium amount immediately and settling the same on a later date, it is known as a Put Option. Put Option has two parties, one a buyer of a Put Option and other a seller of a Put Option.