The trading system on the NCDEX provides a fully automated screen based trading for futures on commodities on a nationwide basis as well as online monitoring and surveillance mechanism. It supports an order driven market and provides complete transparency of trading operations. Order matching is essential on the basis of commodity, its price, time and quantity. All quantity fields are in units and price in rupees. The exchange specifies the unit of trading and the delivery unit for futures contracts on various commodities. The exchange notifies the regular lot size and tick size for each of the contracts traded from time to time.… Read the rest

Indian Financial Market

Junk Bonds in India

Sharp movements in the Indian equity market may be par for the course. But when it comes to the market for corporate bonds, it’s constantly stagnant. The reason is, we don’t have a corporate bond market. But this is overwhelmingly dominated by government securities (about 80% of the total). Of the remaining, close to 80% again comprises privately placed debt of public financial institutions. An efficient bond market helps corporate reduce their financing costs. It enables companies to borrow directly from investors, bypassing the major intermediary role of a commercial bank. One of the important instruments in corporate market is Junk Bonds which could be great source of financing for countries like India where markets are not much regulated.… Read the rest

Financial Market Regulation in India (Guidelines Issued by RBI and SEBI)

Guidelines Issued by Reserve Bank of India for the Regulation of Financial Markets

1) Management oversight, policy/operational guidelines – The management of a Primary Dealer should bear primary responsibility for ensuring maintenance of appropriate standards of conduct and adherence to proper procedures by the entity. Primary Dealers (PD) should frame and implement suitable policy guidelines on securities transactions. Operational procedures and controls in relation to the day-to-day business operations should also be worked out and put in place to ensure that operations in securities are conducted in accordance with sound and acceptable business practices. With the approval of respective Boards, the PDs should clearly lay down the broad objectives to be followed while undertaking transactions in securities on their own account and on behalf of clients, clearly define the authority to put through deals, procedure to be followed while putting through deals, and adhere to prudential exposure limits, policy regarding dealings with brokers, systems for management of various risks, guidelines for valuation of the portfolio and the reporting systems etc.… Read the rest

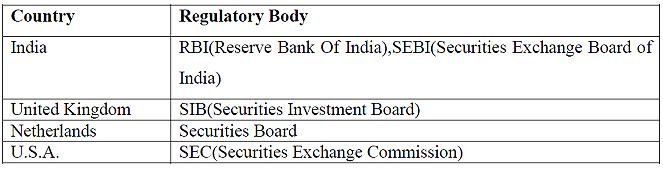

Financial Market Regulation: Meaning and Objectives

Financial Market Regulation

The nature of securities markets is such that they are inherently susceptible to failures due to the existence of information asymmetries and existence of high transaction costs. It needs to be emphasized that when securities markets come into existence, the interest of the member brokers are taken care of through margin requirements, barriers to entry of membership, listing agreements. However the investors/clients who buy and sell via their brokers are not able to form an organization to safeguard their interests due to the cost of creation of such organizations and free rider problems. The distinctive nature of the market can be observed with reference to the commodity, its quality, the system of transactions and the participants in the market, as follows:

(a) the commodity(the security)has a life to perpetuity.… Read the rest

Meaning of Financial Intermediaries

With advances in computer technology, one can transfer money instantly, anywhere in the word, you can trade your funds across major stock exchanges online, you can use your credit card across the globe and so on. Lending and borrowing of money is made simple by financial institutions called financial intermediaries. Financial intermediaries such commercial banks, credit unions and brokerage funds carryout these transactions on your behalf. A financial intermediary is a financial institution that borrows from savers and lend to individuals or firms that need resources for investment. The investments made by financial intermediaries can be in loan and/or securities. Basic role of financial intermediaries is transforming financial assets that are less desirable for a large part of the public into other financial asset, which is preferred more by the public.… Read the rest

Forex Market or Foreign Exchange Market

Foreign exchange refers to money denominated in the currency of another nation or group of nations. Foreign exchange can be cash, bank deposits or other short-term claims. But in the foreign exchange market as the network of major foreign exchange dealers engaged in high-volume trading, foreign exchange almost always take the form of an exchange of bank deposits of different national currency denominations. A Foreign exchange market or Forex market is a market in which currencies are bought and sold. It is to be distinguished from a financial market where currencies are borrowed and lent.

Short History of the Foreign Exchange MarketForeign exchange markets mainly established to make easy cross border trade in which there is involvement of different currencies by governments, companies and individual investors.… Read the rest