A good capital market is an essential prerequisite for the industrial and commercial development of a country. Capital market is a central coordinating and directing mechanism for free and balanced flow of financial resources into the economic system operating in a country. It helps the companies who require capital to expand, modernize or diversify their business. To get the capital that is required by the company it usually goes for the issue of shares and the process of issuing of shares is done in the primary market. The primary market in the simplest terms can be defined as a market where the securities are sold in order to raise the funds or the capital required by the company.… Read the rest

Indian Financial Market

National Securities Clearing Corporation Ltd. (NSCCL)

National Securities Clearing Corporation Ltd. (NSCCL) is a wholly owned subsidiary of NSE and was incorporated in August 1995. It was the first clearing corporation to be established in the country and also the first clearing corporation in the country to introduce settlement guarantee. It was set up with the following objectives:

- to bring and sustain confidence in clearing and settlement of securities;

- to promote and maintain, short and consistent settlement cycles;

- to provide counter-party risk guarantee, and

- to operate a tight risk containment system.

National Securities Clearing Corporation Ltd. carries out the clearing and settlement of the trades executed in the equities and derivatives segments of the NSE, It operates a well-defined settlement cycle and there are no deviations or deferments from this cycle.… Read the rest

Rolling Settlement System

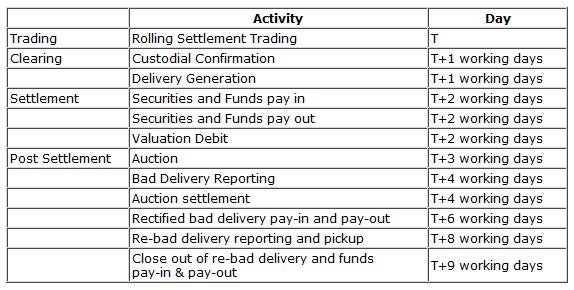

Rolling Settlement process , also known as Compulsory Rolling Settlement (CRS) where trades on a stock exchange were to be accounted for and settled on T i.e. trade day plus “X” trading days, where “X” could be 1,2,3,4 or 5 days. Thus, in essence, it means that if say a T+n, where n is the number of days system of rolling settlement was to be followed, trades accounted for on the T i.e. trade day were to be settled on the nth working day minus the T day.

The Account period of settling transactions was followed in India for a long time.… Read the rest

Listing and Delisting of Securities at Stock Exchanges

Listing means formal admission of a security into a public trading system of a stock exchange. A security is said to be listed when they have been included in the official list of the stock exchange for the purpose of trading. The prime objective of admission to dealings cm the stock exchange is to provide liquidity and marketability to securities and also to provide a mechanism for effective management of trading. The securities listed in stock exchanges may be of any public limited company, central or state government, quasi-government and other corporations or financial institutions.… Read the rest

Inter-Connected Stock Exchange (ISE)

The formation of NSE changed the way in which the stock exchanges were functioning. Modern infrastructure, technology, transparency and corporate governance are now becoming the features in the corporate the world. It also forced BSE to adopt the new technology and with this, NSE and BSE crossed boundaries and started functioning, operating throughout India. This affected the functioning of small and regional exchanges. This led to the birth of the Inter-connected Stock Exchange of India Ltd. (ISE). Federation of Indian stock exchanges, in a meeting held in 1996, constituted a steering committee to evolve an interconnected market system. In 1997, the market governing body of India, Securities and Exchange Board of India (SEBI) granted approval to the proposal of the ISE to set up a national level stock exchange promoted by 14 regional stock exchanges. … Read the rest

Some Facts about Over The Counter Exchange of India(OTCEI)

In 1992 , to provide improved services, the country’s first ring less, scrip less and electronic stock exchange Over The Counter Exchange of India(OTCEI) was created by some of the prominent financial institutions like UTI, ICICI, IDBI , SBI Capital Markets, IFCI, GIC, Canbank Financial Services. The trading at OTCEI is done over the centers across the country. The securities traded at OTCEI are classified into listed securities, permitted securities and initiated debentures. The feature of this exchange is that instead of share certificate, a counter receipt is generated out at the counter which substitutes the share certificate and the same is used for all transactions.… Read the rest