The primary task of a lending institutions before granting a term loan is to assure itself that the anticipated rise in the income of the borrowing unit would materialize, thus providing the necessary funds for repaying the loans according to the terms of amortization. The liquidity of term loans depends not so much on the short-run sale ability of the goods and commodities as on the increased term loan income of borrowing units resulting from a higher level of utilization of existing installed capacity. For assessing the risks involved in term lending, the normal criteria used for judging the soundness of short-term loans are often unreliable and inadequate. The methods of analysis and the standard to be adopted for appraisal of term loans are more similar to investment decisions than to short-term lending. Appraisal of term-loans requires a dynamic approach involving, inter alia, a projection of future trends ofContinue reading

Business Finance

Business Finance is that business activity which is concerned with the acquisition and conservation of capital funds in meeting financial needs and overall objectives of business enterprises.

Loan Against Securities

Considerations of security form an important basis of lending. In fact, they constitute necessary adjunct to financial appraisal. Lending institutions have to examine the loan proposals from the point of view of nature and extent of security offered. Sometimes, there is a greater reliance on security due to inadequate financial appraisal, which in its turn may be due to non-availability of the necessary data. The security cover of the loan should, however, not be regarded as a substitute for an adequate financial assessment. Security considerations are of particular importance in less developed countries like India where information on the character, integrity and credit-worthiness of the borrowers is not readily available and much ground work has yet to be done in the establishment of credit information bureaus. A prudent term lending institution, therefore, secures its loan by adequate collateral and, where necessary, guarantees. It also embodies in the loan agreement suitableContinue reading

Lease vs Hire Purchase

The concept of leasing can be understood by comparing the lease to the purchase of a specific asset. If a firm wishes to obtain the service of a specific asset, it has two alternatives: Purchase or Lease. To purchase the asset, the firm must payout a lump sum or agrees to some type of installment plan that involves incurring a long term liability. Leasing the assets, on the other hand, provides the firm with asset’s services without necessarily incurring any capital liability. Leasing is a source of financing as it enables the firm to obtain the use of assets in exchange for agreeing to pay lease rentals. In case of leasing, the asset is handed over by the lessor to the lessee in return for a lease rental. The ownership and the title to the assets remain with the lessor. The lessor, however, recovers the cost of the assets asContinue reading

Types of Finance Lease Agreements

A finance lease, also called a capital lease, is one which usually covers the full useful economic life of the assets or a period that is close to the economic life. The lessor receives lease rentals during the lease period so as to recover fully not only the cost of the assets but also a reasonable return on the funds used to buy the assets. The finance lease is usually a non-cancellable and the lessee provides for the maintenance of the assets. The lease payment under financial lease is a payment for the use of the assets only and the responsibility for the repair and maintenance of the assets generally lies with the lessee. Since the term of a finance lease is normally closely aligned with the economic life of the assets, the lessee’s position is quite similar that of an owner; and the cost of maintaining is in itsContinue reading

Lease Financing in Lessor’s View Point

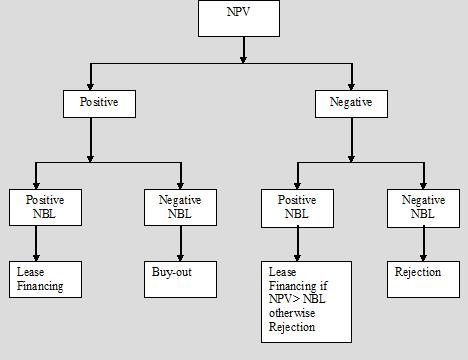

In normal situations, the lease decision has been evaluated from the point of the lessee in terms of the lease or buy decision. However, the lessor also has to evaluate the lease decisions from the point of view of his return. The lessor is financing the assets out of the funds procured from different sources, and obviously there is a cost of all these funds to the lessor. So, the lessor will like to provide lease financing only if the return from the lease is at least equal to the overall cost of capital of the lessor. The lease decision for a lessor is in fact a capital budgeting decision, where the lessor invests the funds in expectation of the returns in the form of lease rentals. The lessor will accept the proposal for the lease financing only if the NPV of the decision is positive at the required rateContinue reading

Lease vs Buy Decision

A lease is a contractual arrangement whereby one party (i.e., the owner of an asset) grants the other party the right to use the asset in return for a periodic payment. A lease is essentially the renting of an asset for some specified period. The owner of the assets is called the lessor while the other party that uses the assets is known as the lessee. A lessee can be an individual. a firm or a company interested in the use of the assets without owning it, while the lessor may be the seller, supplier, a finance company or the manufacturer who can finance the purchase of the assets. Under the lease contract, the ownership of the assets remains with the lessor whereas the use of the assets is available to the lessee. In return, the lessee has to pay a fixed periodic amount to the lessor. This periodic paymentContinue reading