Liberalisation process has increasingly exposed Indian Industry to international competition and banking being a service industry is also not an exception. Banking Sector in India too faces same strains and challenges at local, national and international level. Indian Banks, functionally diverse and geographically widespread, have played a crucial role in the socio-economic progress of the country after independence. However, the growth led to strains in the operational efficiency of banks and the accumulation of non-performing assets (NPA’s) in their loan portfolios. Banks face increasing pressure to stand out from the crowd. On the Internet, this means offering your target customers an increasingly broader range of services than your competitors and that too in unique way. All this has resulted inContinue reading

Indian Banking System

Recent Trends in Indian Banking Sector

Today, we are having a fairly well developed banking system with different classes of banks — public sector banks, foreign banks, private sector banks — both old and new generation, regional rural banks and co-operative banks with the Reserve Bank of India as the fountain Head of the system. In the banking field, there has been an unprecedented growth and diversification of banking industry has been so stupendous that it has no parallel in the annals of banking anywhere in the world. During the last 41 years since 1969, tremendous changes have taken place in the banking industry. The banks have shed their traditional functions and have been innovating, improving and coming out with new types of the services toContinue reading

Role of Information Technology (IT) in the Banking Sector

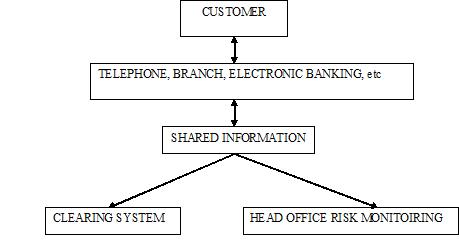

Banking environment has become highly competitive today. To be able to survive and grow in the changing market environment banks are going for the latest technologies, which is being perceived as an ‘enabling resource’ that can help in developing learner and more flexible structure that can respond quickly to the dynamics of a fast changing market scenario. It is also viewed as an instrument of cost reduction and effective communication with people and institutions associated with the banking business. The Software Packages for Banking Applications in India had their beginnings in the middle of 80s, when the Banks started computerising the branches in a limited manner. The early 90s saw the plummeting hardware prices and advent of cheap and inexpensiveContinue reading

Customer Services in Commercial Banks

Customer service is the service provided in support of a bank’s core products. Customer service often includes answering questions; handling complaints. Customer service can occur on site (as when an onstage employee helps a customer or answers a question) or it can occur over the phone or the Internet. Quality customer service is essential to building cordial customer relationship. Banking being a service industry, a lot depends on efficient and prompt customer service. Customer service is the most important duty of the banking operations. Prompt and efficient service with smile will develop good public relations reduce complaints and increase business. Why is Customer Service Important? Changing customer expectations: Today the customer is more demanding and more sophisticated than he orContinue reading

Different Products and Services Offered by Banks

Broad Classification of Products Offered by Banks The different products in a bank can be broadly classified into: Retail Banking. Trade Finance. Treasury Operations. Retail Banking and Trade finance operations are conducted at the branch level while the wholesale banking operations, which cover treasury operations, are at the head office or a designated branch. Retail Banking: Deposits Loans, Cash Credit and Overdraft Negotiating for Loans and advances Remittances Book-Keeping (maintaining all accounting records) Receiving all kinds of bonds valuable for safe keeping Trade Finance: Issuing and confirming of letter of credit. Drawing, accepting, discounting, buying, selling, collecting of bills of exchange, promissory notes, drafts, bill of lading and other securities. Treasury Operations: Buying and selling of bullion, Foreign exchange. Acquiring,Continue reading

Organizational Structure and Role of Banks in India

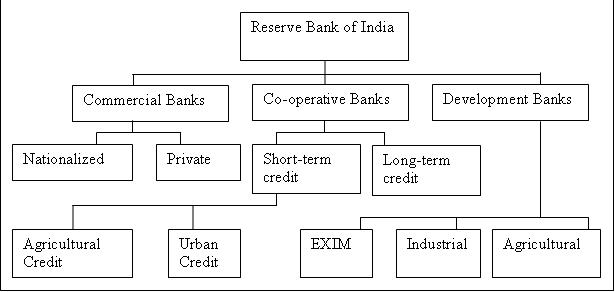

Banking Regulation Act of India, 1949 defines Banking as “accepting, for the purpose of lending or of investment of deposits of money from the public, repayable on demand or otherwise or withdrawable by cheque, draft order or otherwise.” The Reserve Bank of India Act, 1934 and the Banking Regulation Act, 1949, govern the banking operations in India. Organizational Structure of Banks in India: In India banks are classified in various categories according to differ rent criteria. The following figure indicate the banking structure: 1. The Reserve Bank of India (RBI): The RBI is the supreme monetary and banking authority in the country and has the responsibility to control the banking system in the country. It keeps the reserves of allContinue reading