Banking Regulation Act of India, 1949 defines Banking as “accepting, for the purpose of lending or of investment of deposits of money from the public, repayable on demand or otherwise or withdrawable by cheque, draft order or otherwise.” The Reserve Bank of India Act, 1934 and the Banking Regulation Act, 1949, govern the banking operations in India.

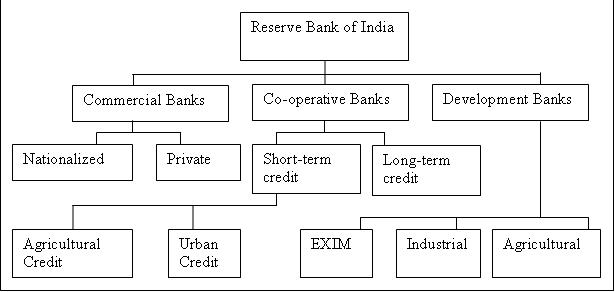

Organizational Structure of Banks in India:

In India banks are classified in various categories according to differ rent criteria. The following figure indicate the banking structure:

1. The Reserve Bank of India (RBI): The RBI is the supreme monetary and banking authority in the country and has the responsibility to control the banking system in the country. It keeps the reserves of all scheduled banks and hence is known as the “Reserve Bank”.

2. Public Sector Banks:

- State Bank of India and its Associates

- Nationalized Banks

- Regional Rural Banks Sponsored by Public Sector Banks

3. Private Sector Banks:

- Old Generation Private Banks

- Foreign New Generation Private Banks

- Banks in India

4. Co-operative Sector Banks:

- State Co-operative Banks

- Central Co-operative Banks

- Primary Agricultural Credit Societies

- Land Development Banks

- State Land Development Banks

5. Development Banks: Development Banks mostly provide long term finance for setting up industries. They also provide short-term finance (for export and import activities)

- Industrial Finance Co-operation of India (IFCI)

- Industrial Development of India (IDBI)

- Industrial Investment Bank of India (IIBI)

- Small Industries Development Bank of India (SIDBI)

- National Bank for Agriculture and Rural Development (NABARD)

- Export-Import Bank of India

Role of Banks:

Banks play a positive role in economic development of a country as repositories of community’s savings and as purveyors of credit. Indian Banking has aided the economic development during the last fifty years in an effective way. The banking sector has shown a remarkable responsiveness to the needs of planned economy. It has brought about a considerable progress in its efforts at deposit mobilization and has taken a number of measures in the recent past for accelerating the rate of growth of deposits. As recourse to this, the commercial banks opened branches in urban, semi-urban and rural areas and have introduced a number of attractive schemes to foster economic development.

The activities of commercial banking have growth in multi-directional ways as well as multi-dimensional manner. Banks have been playing a catalytic role in area development, backward area development, extended assistance to rural development all along helping agriculture, industry, international trade in a significant manner. In a way, commercial banks have emerged as key financial agencies for rapid economic development.

By pooling the savings together, banks can make available funds to specialized institutions which finance different sectors of the economy, needing capital for various purposes, risks and durations. By contributing to government securities, bonds and debentures of term-lending institutions in the fields of agriculture, industries and now housing, banks are also providing these institutions with an access to the common pool of savings mobilized by them, to that extent relieving them of the responsibility of directly approaching the saver. This intermediation role of banks is particularly important in the early stages of economic development and financial specification. A country like India, with different regions at different stages of development, presents an interesting spectrum of the evolving role of banks, in the matter of inter-mediation and beyond.

Mobilization of resources forms an integral part of the development process in India. In this process of mobilization, banks are at a great advantage, chiefly because of their network of branches in the country. And banks have to place considerable reliance on the mobilization of deposits from the public to finance development programmes. Further, deposit mobalization by banks in India acquired greater significance in their new role in economic development.

Commercial banks provide short-term and medium-term financial assistance. The short-term credit facilities are granted for working capital requirements. The medium-term loans are for the acquisition of land, construction of factory premises and purchase of machinery and equipment. These loans are generally granted for periods ranging from five to seven years. They also establish letters of credit on behalf of their clients favouring suppliers of raw materials/machinery (both Indian and foreign) which extend the banker’s assurance for payment and thus help their delivery. Certain transaction, particularly those in contracts of sale of Government Departments, may require guarantees being issued in lieu of security earnest money deposits for release of advance money, supply of raw materials for processing, full payment of bills on the assurance of the performance etc. Commercial banks issue such guarantees also.