Forward exchange rates, like spot exchange rates are determined by the demand for and the supply of forward exchange. If the supply of forward exchange exceeds the demand for it, the forward rates will be quoted at a discount over the spot rate i.e., forward exchange rate will be lower than the spot exchange rate. On the other hand, if the demand for forward exchange exceed its supply, the forward rates will be quoted at a premium over the spot rate i.e., forward rate will be quoted at a premium over the spot rate i.e., forward rate will be higher than the spot rate.… Read the rest

International Trade Finance

Types of Packing Credit (Pre-Shipment Credit)

Packing Credit is a pre-shipment credit extended to the exporters to facilitate him for meeting several financial requirements such as purchase of raw materials and its processing, packing, storing and shipping of goods. It is a short term credit available to all exporters. Hence, this is called pre-shipment credit which is essentially working capital finance made available to the exporters to arrange for goods as per the export. It is generally granted in the form of loans or cash credits. It may also be granted in the form of overdraft facilities. The exporter who wants to avail the pre-shipment credit facility should make a formal application to his bank along with the firm contract with the buyer or a copy of the export order or a copy of the letter of credit.… Read the rest

Pre-Shipment Inspection

Pre-shipment inspections (PSI) is defined as the certification of the value, quality, and/or identity of traded goods done in the exporting country by specialized agencies or firms on behalf of the importing country. Traditionally used as a means to prevent over-or under-invoicing, it is now being used as a security measure.

Pre-shipment inspections are required when mandated by the government of the importing country. Governments assert that pre-shipment inspections ensure that the price charged by the exporter reflects the true value of the goods, prevent substandard goods from entering their country, and mitigate attempts to avoid the payment of customs duties.… Read the rest

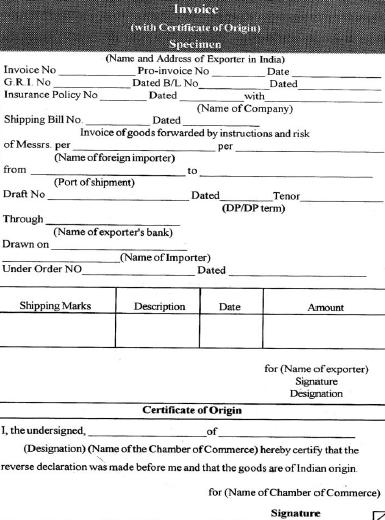

Common Export Documents – Export Invoice

An export invoice is the basic document which gives full details of the contents of the shipment and serves as seller‘s bill of goods and sets out the terms of sale. An invoice usually means a Commercial invoice. An exporter must prepare this document which will fully identify the overseas shipment and serve as a basis for the preparation of all other documents.

There is no standard form for an export invoice and it is the exporter’s choice to design his own form. The invoice is prepared for the buyer abroad. Any special requirement of the importer must be duly complied with.… Read the rest

Comprehensive Income Taxation

The comprehensive income tax system also known by other synonyms as global income tax, unitary income tax or synthetic income tax is the most used taxation system in western European countries. It has got its name due to the fact that all income types are seen as a one and therefore are added together and taxed as one whole income. It was seen as the ideal tax system in Europe because in its original form it could align fully with the “ability to pay principle” and to both tasks of simplicity and fairness. This method is composed as a system which adds together all the taxpayer’s income (from labor, capital, rent and business) in a single measure and taxes it with a single progressive tax.… Read the rest

Difference Between Letter of Credit and Guarantee

A letter of credit is a written undertaking issued by buyer’s bank to pay a certain sum of money within a stipulated period against a specified set of documents. It is a conditional undertaking. It undertakes to pay a certain amount of money on presentation of stipulated documents and the fulfillment by the exporter of all the terms and conditions incorporated in the L/C. The Letter of credit is a separate and distinct contract from the underlying sale contract, and the bank is not responsible for the fulfillment of the terms of the sale contract. The essential and basic provisions of the sale contract must be incorporated in the letter of credit.… Read the rest