Portfolio Selection Portfolio analysis provides the input for the next phase in portfolio management, which is portfolio selection. The proper goal of portfolio construction is to generate a portfolio that provides the highest returns at a given level of risk. A portfolio having this characteristic is known as an efficient portfolio. The inputs from portfolio analysis can be used to identify the set of efficient portfolios. From this set of efficient portfolios the optimum portfolio has to be selected for investment. Harry Markowitz portfolio theory provides both the conceptual framework and analytical tools for determining the optimal portfolio in a disciplined and objective way. Portfolio Revision Once the portfolio is constructed, it undergoes changes due to changes in market pricesContinue reading

Investment Analysis

Portfolio Analysis in Investment Portfolio Management

The main aim of portfolio analysis in investment portfolio management is to give a caution direction to the risk and return of an investor on portfolio. Individual securities have risk return characteristics of their own. Therefore, portfolio analysis indicates the future risk and return in holding of different individual instruments. The portfolio analysis has been highly successful in tracing the efficient portfolio. Portfolio analysis considers the determination of future risk and return in holding various blends of individual securities. An investor can sometime reduce portfolio risk by adding another security with greater individual risk than any other security in the portfolio. Portfolio analysis is mainly depending on Risk and Return of the portfolio. The expected return of a portfolio shouldContinue reading

Definition of Portfolio Management

Portfolio Management Definition It is a process of encompassing many activities of investment in assets and securities. The portfolio management includes the planning, supervision, timing, rationalism and conservatism in the selection of securities to meet investor’s objectives. It is the process of selecting a list of securities that will provide the investor with a maximum yield constant with the risk he wishes to assume. The portfolio management is growing rapidly serving broad array of investors — both individual and institutional — with investment portfolio ranging in asset size from few thousands to crores of rupees. Despite growing importance, the subject of portfolio and investment management is new in the country and is largely misunderstood. In most cases, portfolio management hasContinue reading

Financial and Economic Meaning of Investment

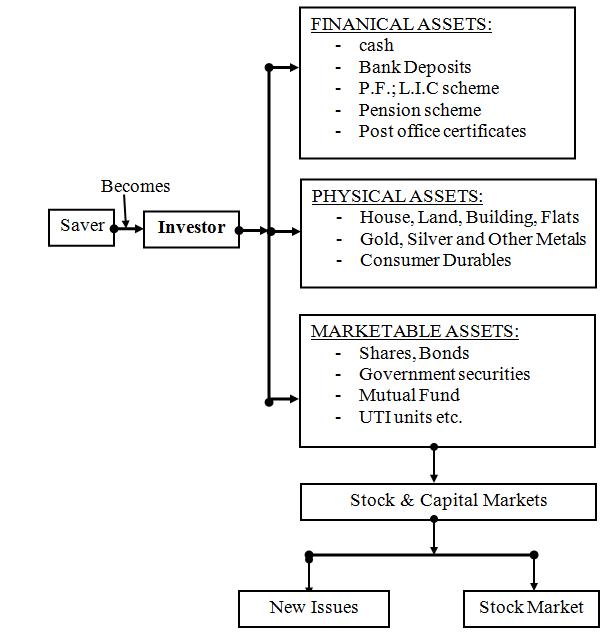

Investment is the employment of funds with the aim of getting return on it. In general terms, investment means the use of money in the hope of making more money. In finance, investment means the purchase of a financial product or other item of value with an expectation of favorable future returns. Investment of hard earned money is a crucial activity of every human being. Investment is the commitment of funds which have been saved from current consumption with the hope that some benefits will be received in future. Thus, it is a reward for waiting for money. Savings of the people are invested in assets depending on their risk and return demands. Investment refers to the concept of deferredContinue reading

Three Types of Portfolio Investments

Portfolio management is a process encompassing many activities of investment in assets and securities. It is a dynamic and flexible concept and involves regular and systematic analysis, judgment and action. The objective of this service is to help the unknown and investors with the expertise of professionals in investment portfolio management. It involves construction of a portfolio based upon the investor’s objectives, constraints, preferences for risk and returns and tax liability. The portfolio is reviewed and adjusted from time to time in tune with the market conditions. The evaluation of portfolio is to be done in terms of targets set for risk and returns. The changes in the portfolio are to be effected to meet the changing condition. Portfolio constructionContinue reading

Basic Investment Objectives

Investing is a wide spread practice and many have made their fortunes in the process. The starting point in this process is to determine the characteristics of the various investments and then matching them with the individuals need and preferences. All personal investing is designed in order to achieve certain objectives. These objectives may be tangible such as buying a car, house etc. and intangible objectives such as social status, security etc. similarly; these objectives may be classified as financial or personal objectives. Financial objectives are safety, profitability, and liquidity. Personal or individual objectives may be related to personal characteristics of individuals such as family commitments, status, dependents, educational requirements, income, consumption and provision for retirement etc. The basic objectivesContinue reading