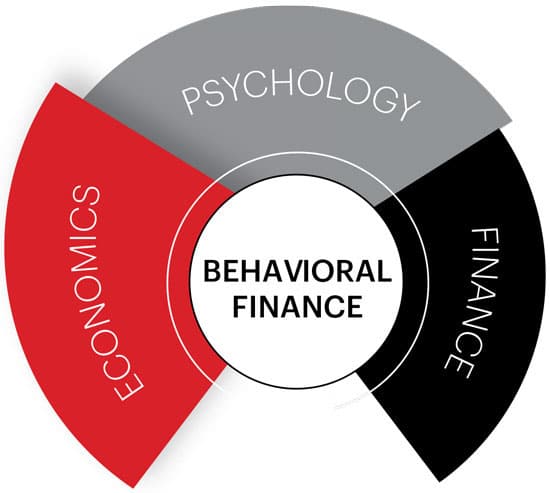

Traditionally, economics and finance have focused on models that assume rationality. The behavioral insights have emerged from the application of insights from experimental psychology in finance and economics.

Behavioral finance is relatively a new field which seeks to provide explanation for people’s economic decisions. It is a combination of behavioral and cognitive psychological theory with conventional economics and finance. Inability to maximize the expected utility (EU) of rational investors leads to growth of behavioral finance within the efficient market framework. Behavioral finance is an attempt to resolve inconsistency of Traditional Expected Utility Maximization of rational investors within efficient markets through explanation based on human behavior.… Read the rest