The Lemon Market Theory (LMT) explained by Nobel Prize winner George A. Akerlof in 1970 in his seminal paper, “The Market for Lemons: Quality Uncertainty and the Market Mechanism” describes how markets that sell good products is never identified because of poor quality supplying markets, as sellers of the poor quality products are provided incentives to sell their products. Incentives such as guarantees, warranties and brand names oppose the quality uncertainty issue. The Lemon Market Theory also focuses on the information asymmetry or unbalanced information between the buyer and seller, where the entire set of sellers take the credit for the quality of the product or service rather than granting the individual quality reward to the appropriate seller who provides the good quality ones. This result in extinguishing the existence of good quality sellers from the market because their product’s quality or service is never recognized or identified and they are not rewarded either.

In his theory Akerlof also talks about “Cost of dishonesty” where the cost includes the dishonesty exercised by the lemon sellers to sell their products to buyers who know certain statistics of the market and consider average market quality. The cost also includes the demanding force that drives away the innocent good quality businesses from the market. He considers the cost of dishonesty to support the framing of business in underdeveloped countries is difficult.

Akerlof exemplifies the market for used cars to portray the lemon market problem. The problem finds its way by considering four kinds of car: new car, used car, good car and bad car (“lemons”). The buyer of a new car buys without any prior knowledge of the car and thus the car maybe a lemon or it may not be a lemon. A used car could also be a good car or a lemon. To explain how innocent buyers fall into the trap by the trader, two probabilities are used. Probability p denotes the good quality and probability (1-p) denotes the lemon. After a span of time, the owner of the car assigns a new probability on a bad experience note. An asymmetry arises because the trading of the purchased lemons with the same price or even an equivalent amount spent during its purchase was impractical.

The lemon problem investigates using two types of information: asymmetrical information and symmetrical information. Assumes that the demands of a used car depend on the price of the used car as well as its quality and both the supply of the used car and the quality of the car depends on its price. Thus as the price falls, the quality suffers. From the utility theory, two type of traders, trader type 1 and trader type 2 are considered. By observing the income of the two types of traders, demands for the used cars will be the sum of the demands of both types of traders. On a contrast note, the symmetrical information proves that utility wins the contest and the income of the traders are not enough to buy automobiles. With several assumptions and conditions, quality is only half times the price of the car and trades take place when traders of one type (type 2) are capable of paying the price offered by type 1 traders.

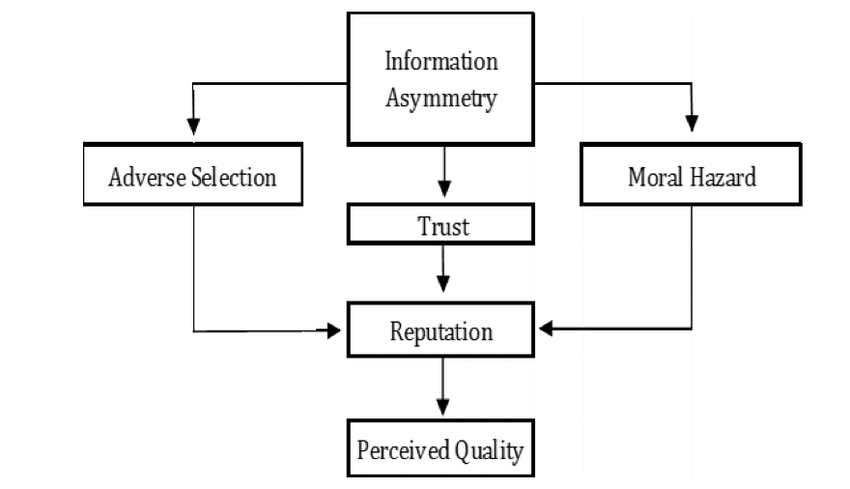

In the paper ‘SMEs and IT: Evidence for a Market for “Lemons”’ by Jan Devos, Hendrik Van Landeghem and Dirk Deschoolmeester of Ghent University, Belgium, Devos et al derives a structure that was used to measure and verify and affirm the Lemon Market Theory. The figure below sketches out the basic network framework.

- Information Asymmetry: The unbalanced information between two communicating people of different backgrounds is Information Asymmetry. It is an “independent construct” because the skills of either of the two communicating people play a drastic role. Within the areas of trading, the buyer or the seller compromises on the trade based on the information exchanged between them. The information may be inappropriate or unbalanced attracting lemons into the market.

- Trust: Trust is a dependent construct and can be been seen as a coordinating mechanism based on shared moral values and norm supporting collective co-operation and collaboration within uncertain environments. It is a connecting dependent construct between information asymmetry and reputation. Information asymmetry destroys the trust among traders and thus spoiling the reputation of the trading company. Often trust is the key element between several successful businesses.

- Reputation: Reputation is a characteristic or attribute ascribed to one person (or organization) by another (or organization). Reputation is the reward to honesty. When a market lacks reputation, the traders use institutions to sell products of low quality, thus reputation could be a solution to the lemon problem. Reputation is never a one-man property; a group of traders who try to gain success out of it always inherits it.

- Adverse selection: The most common mistake all buyers do is selecting the wrong seller. The buyer has no prior knowledge about the product purchased and thus trusting the tactics the sellers impose, the buyers fall into their trap. From the seller’s perspective, adverse selection results in loss in reputation and a prominent decline in the quality of the product.

- Moral hazard: Many a times, the seller does not meet the standard quality requirements of the buyer. He tries to hide information about the defect and problems in the product on sale, which gives rise to moral hazards.

Lemon Markets results impacts of two kinds, which may be good or bad. A good impact may prevent the growth of a lemon market but a bad impact establishes a firm lemon market and thus the bad quality ones force the good quality products out. Thus, fresh traders finding their way into the markets can prevent the further growth of a lemon market. Innocent buyers save themselves from falling into trap of the sellers by being more aware of their purchase. This would comparatively reduce information asymmetry. Nevertheless, sellers can also contribute to the decline in information asymmetry by discussing the mechanical issues and problems of the used automobile thus saving an entry of new lemon into the market.

Eric W.Bond in his paper ‘A Direct Test of ‘Lemons’ Model : The Market for Used Pickup trucks’, argues that there is no appropraite information that proves, lemons empower the used car markets. Bond choose maintenance, a key to measure and evaluate the quality of a truck with high maintenance vehicles as lemons. These lemons drive out the non-lemons from the markets. It is natural that used vehicles have higher maintenance costs when compared to new vehicles, if it did not then all lemon owner would trade their vehicles for a new one. Nevertheless, if the age and mileage was controlled, there would be no difference in the two categories. Reputation eliminates the chances of lemon entering the market, because rendering a bad quality may affect the reputation adversely. Information asymmetry disappears with the fact that buyers gain the required information and knowledge of the quality of the product thus there is no chances of buying a lemon. The market would result in trading the good quality vehicles obstructing or obscuring the entry of lemon. This contradicts with the Akerlof’s Lemon Market Theory.