There are various options available for the revival of a ‘sick company. One is buyout of such a company by its employees. This option has distinct advantages over Government intervention and other conventional remedies. Buyout by employees provides a strong incentive to the employees in the form of personal stake in the company. The employees become the owners of the company by virtue of the shares that are issued and allotted to them. Moreover, continuity of job is the greatest motivating force which keeps them on their toes to ensure that the buyout succeeds. Such a buyout saves mass unemployment and unrest among the working class.… Read the rest

Business Strategies

Role of Luck in Strategic Management

While some firms hope to yield above expected normal returns from implementing business strategies, they must however be consistently conversant with the future value of those strategies than other firms playing in the same market. Other firms gain advantage in strategy implementation which is either a manifestation of these special insights into the future value of strategies, or a manifestation of a firm’s good fortune and luck, as sometimes, the price of the strategic resource acquired may be based on expectations on the return potential of that strategy

However, unexpected greater organisational profits can simply be unexpected, a surprise, and a manifestation of a firm’s good luck and possibly not its ability to accurately anticipate the future value of a strategy.… Read the rest

Effects of Innovative Culture on Organizations

Growth creates a need for structure and discipline, organisation changes which can strain the culture of creativity that is so vital to future success. To sustain competitive advantage, companies need to institutionalize the innovation process; they need to create an internal environment where creative thinking is central to their values, assumptions and actions.

Management changes and management generally is about implementation. When the managers of an enterprise feel pressured, the fear-driven response is generally to implement better and which generally results doing more of the same only quicker or cheaper. While this is great for doing more of the same, it is still the same and meanwhile everything else is changing — customer’s needs, technology, society, macroeconomics and geopolitics are all changing.… Read the rest

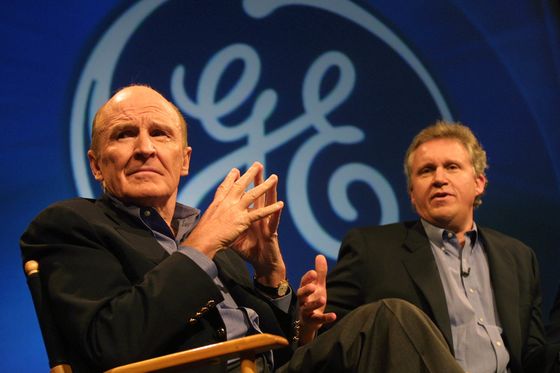

Case Study of Comparing GE’s Two Leaderships – Jack Welch and Jeffrey Immelt

Thomas Alva Edison established Edison Electric Light Company in 1878. General Electric Company, known as and commonly abbreviated simply to GE, was formed in 1892, as a result of a merger of the competing companies Edison General Electric Company and the Thomson-Houston Electric Company. Having its headquarters in United States, GE is a major technology conglomerate and is the only company listed in the Dow Jones Industrial Index today that was also included in the original index of 1896. GE is a big multinational corporation and has a diversified infrastructure. Its business activities span a wide range of areas from aircraft engines, industrial products, water processing products, power generation to financial services, medical diagnostic imaging, security technology, consumer financing, and television programming.… Read the rest

Business Combination Strategies

A combination strategy is the pursuit of two or more of the previous strategies simultaneously. For example, one business in the company may be pursuing growth while another in the same company is contracting. In the spring of 1989, for instance, Texas Air was rapidly expanding its Continental Airlines unit. But its Eastern Airlines operation was being consolidated. Eastern’s management was selling off routes and planes, cutting back the number of cities served, and making plans for operating a much smaller airline.

A combination strategy simultaneously employs more than one of the other strategies. This often reflects different strategic approaches among subsystems.… Read the rest

Strategies for Stability

Stability strategy is a strategy in which the organization retains its present strategy at the corporate level and continues focusing on its present products and markets. The firm stays with its current business and product markets; maintains the existing level of effort; and is satisfied with incremental growth. It does not seek to invest in new factories and capital assets, gain market share, or invade new geographical territories. Organizations choose this strategy when the industry in which it operates or the state of the economy is in turmoil or when the industry faces slow or no growth prospects. They also choose this strategy when they go through a period of rapid expansion and need to consolidate their operations before going for another bout of expansion.… Read the rest