A business organization may be financially sound today but it may loose strength tomorrow because of losses. Therefore it is necessary to maintain a judicious balance between the owned capital and borrowed capital. The following ratios have been calculated to analyze the capital structure of a company. 1. Capital Gearing Ratio Capital Gearing Ratio of an organization measures the relationship between equity share capital to preference capital and loan capital. ‘Capital gearing’ refers to the ratio between the variable cost bearing capital and fixed cost bearing capital of the organization and helps to frame the capital structure of the organization. Capital gearing may be of three types: High Gearing Capital, which indicates the excess of interest bearing long-term finance over the equity funds; Low Gearing Capital, which indicates the excess of equity funds over the interest bearing long-term finance; and Evenly Geared, which indicates the equality between the interest bearingContinue reading

Financial Management Tools

Real Options Method in Capital Budgeting

Real options method is one of the investment appraisal techniques for capital budgeting which can deal with the limitations of the Net Present Value (NPV) method. Real options method is a method of evaluating and managing strategic investments decisions in an uncertain business environment. Using real option methods has been recognized that the application of standard NPV techniques can lead to wrong conclusions in the presence of unrecognized embedded options. The central role of NPV techniques in financial decision making therefore makes it imperative that real option structures in investing opportunities are identified and accounted for. It turns out that real options can be found in most live environments where uncertainty or risk, waiting, investment irreversibility, growth opportunity, asymmetric information, staged investments, competitor response, economies of scale, project switching, suspension, abandonment and start-up are important. In fact, these include the full spectrum of investment decision making, including those concerning capitalContinue reading

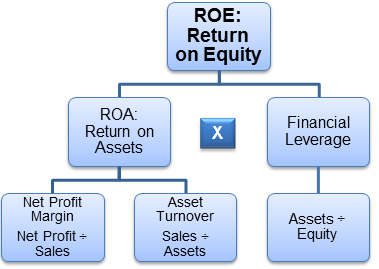

DuPont Analysis – Return on Equity (ROE) Analysis

Financial statement analysis is employed for a variety of reasons. Outside investors are seeking information as to the long run viability of a business and its prospects for providing an adequate return in consideration of the risks being taken. Creditors desire to know whether a potential borrower or customer can service loans being made. Internal analysts and management utilize financial statement analysis as a means to monitor the outcome of policy decisions, predict future performance targets, develop investment strategies, and assess capital needs. As the role of the credit manager is expanded cross-functionally, he or she may be required to answer the call to conduct financial statement analysis under any of these circumstances. The DuPont analysis is a useful tool in providing both an overview and a focus for such analysis. History of DuPont Analysis The DuPont model of financial analysis was made by F. Donaldson Brown, an electrical engineerContinue reading

Total Return Swaps (TRS)

Total Return Swaps (TRS), sometimes known as a total rate of return swaps or TR swaps, are an on off-balance sheet transaction for the party who pays total returns composed of capital gains or losses plus the ordinary coupon or dividend, and receives LIBOR plus spread related to the counterparty’s credit riskiness on a given notional principal. The bank paying total returns is effectively warehousing, renting out its balance sheet while transferring economic value and risk to preferably an uncorrelated counterparty to the referenced assets. A TRS is similar to a plain vanilla swap except the deal is structured such that the total return (cash flows plus capital appreciation/depreciation) is exchanged, rather than just the cash flows. It is one of the principal instruments used by banks and other financial instruments to manage their credit risk exposure, and as such is a credit derivative. They are used as credit riskContinue reading

Different Types of Securitized Instruments

Pass Through Certificates and Pay Through Certificates There is no uniform name for the securities issued by the special purpose vehicle (SPV) as such securities take different forms. These securities could either represent a direct claim of the investors on all that the SPV collects from the receivables transferred to it: in this case, the securities are called pass through certificates as they imply certificates of proportional beneficial interest in the assets held by the SPV. Alternatively, the SPV might be re-configuring the cash flows by reinvesting it, so as to pay to the investors on fixed dates, not matching with the dates on which the transferred receivables are collected by the SPV. In this case, the securities held by the investors are called pay through certificates. 1. Pass Through Certificates In case of pass through certificates payments to investors depend upon the cash flow from the assets backing suchContinue reading

Types of Securitization Structures

Through securitization process, debts are factored and discounted in a structured and sophisticated manner which allows for the availability of funds and the repayment of the debt obligations through the creation of an insolvency remote vehicle which is separate, distinct and independent of the Originator. Securitization structures are most appropriate for a company that seeks financing but is unable to tap funding sources for the desired tenor and funding cost because of its perceived credit risk. In general, any asset class with relatively predictable cash flows can be securitized. The Special Purpose Vehicle (SPV) re-designs the type of bonds to be issued depending on the deal structure. The broad types of securitization structures include: Cash vs. Synthetic Structures: Most transactions world over follow the cash structure in which the originator sells assets and receives cash instead. In a synthetic transaction, the seller keeps his title and investment on the assetsContinue reading