The entire scenario of security analysis is built on two concepts of security: Return and risk. The risk and return constitute the framework for taking investment decision. Return from equity comprises dividend and capital appreciation. To earn return on investment, that is, to earn dividend and to get capital appreciation, investment has to be made for some period which in turn implies passage of time. Dealing with the return to be achieved requires estimated of the return on investment over the time period. Risk denotes deviation of actual return from the estimated return. This deviation of actual return from expected return may be on either side — both above and below the expected return. However, investors are more concerned with the downside risk.

The risk in holding security deviation of return deviation of dividend and capital appreciation from the expected return may arise due to internal and external forces. That part of the risk which is internal that in unique and related to the firm and industry is called ‘unsystematic risk’. That part of the risk which is external and which affects all securities and is broad in its effect is called ‘systematic risk’.

The fact that investors do not hold a single security which they consider most profitable is enough to say that they are not only interested in the maximization of return, but also minimization of risks. The unsystematic risk is eliminated through holding more diversified securities. Systematic risk is also known as non-diversifiable risk as this can not be eliminated through more securities and is also called ‘market risk’. Therefore, diversification leads to risk reduction but only to the minimum level of market risk.

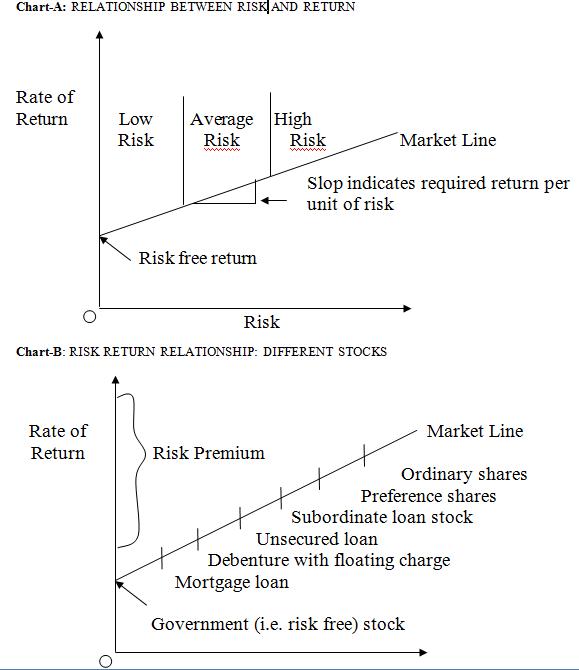

The investors increase their required return as perceived uncertainty increases. The rate of return differs substantially among alternative investments, and because the required return on specific investments change over time, the factors that influence the required rate of return must be considered.

Above chart-A represent the relationship between risk and return. The slop of the market line indicates the return per unit of risk required by all investors highly risk-averse investors would have a steeper line, and Yields on apparently similar may differ. Difference in price, and therefore yield, reflect the market’s assessment of the issuing company’s standing and of the risk elements in the particular stocks. A high yield in relation to the market in general shows an above average risk element. This is shown in the Char-B