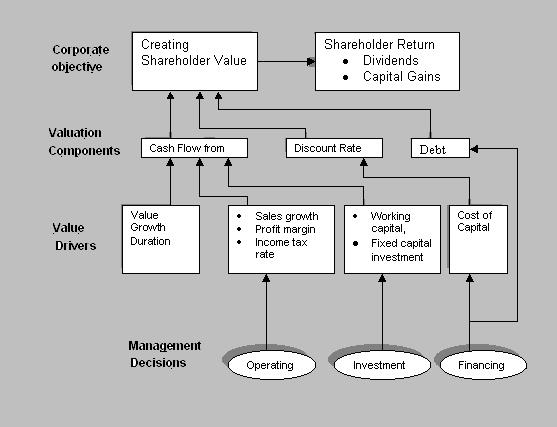

Market Activated Corporate Strategy (MACS) Framework was developed in the late 1980s. But it wasn’t developed at once. There were several predecessors to this framework.

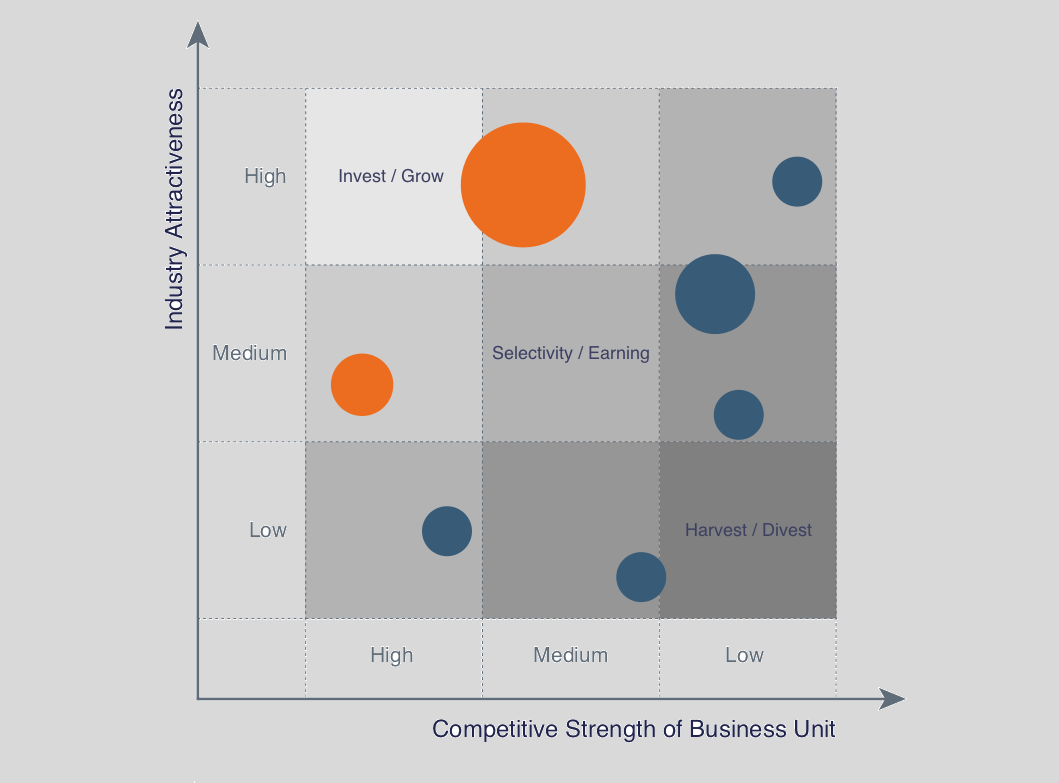

Once of the first can be the BCG Growth-Share Matrix. This matrix represents the market growth rate and the relative market share, and according to the level, the business units were divided into 4 categories. It was used very often before, but over the time more comprehensive tools were designed, to eliminate the weaknesses of BCG Matrix, like the fact that is takes into consideration only two factors, avoiding many many others that have a huge impact on profitability.… Read the rest