The origin of the SCP (Structure-Conduct-Performance) paradigm can be traced to the work of the Harvard economist Edward Mason in the 1930s. It was popularized during 1930-60 with its empirical work involving the identification of correlations between industry structure and performance. This is a paradigm that is foundational to industrial organization economics, consistent with the positional view of strategy, as opposed to the resource-based view of strategy. There are two competing hypotheses in the SCP paradigm: the traditional “structure performance hypothesis” and “efficient structure hypothesis”. The structure performance hypothesis states that the degree of market concentration is inversely related to the degree of competition. This is because market concentration encourages firms to collude. The efficiency structure hypothesis states that performance of the firm is positively related to its efficiency. This is because market concentration emerges from competition where firms with low cost structure increase profits by reducing prices and expandingContinue reading

Strategic Management Tools

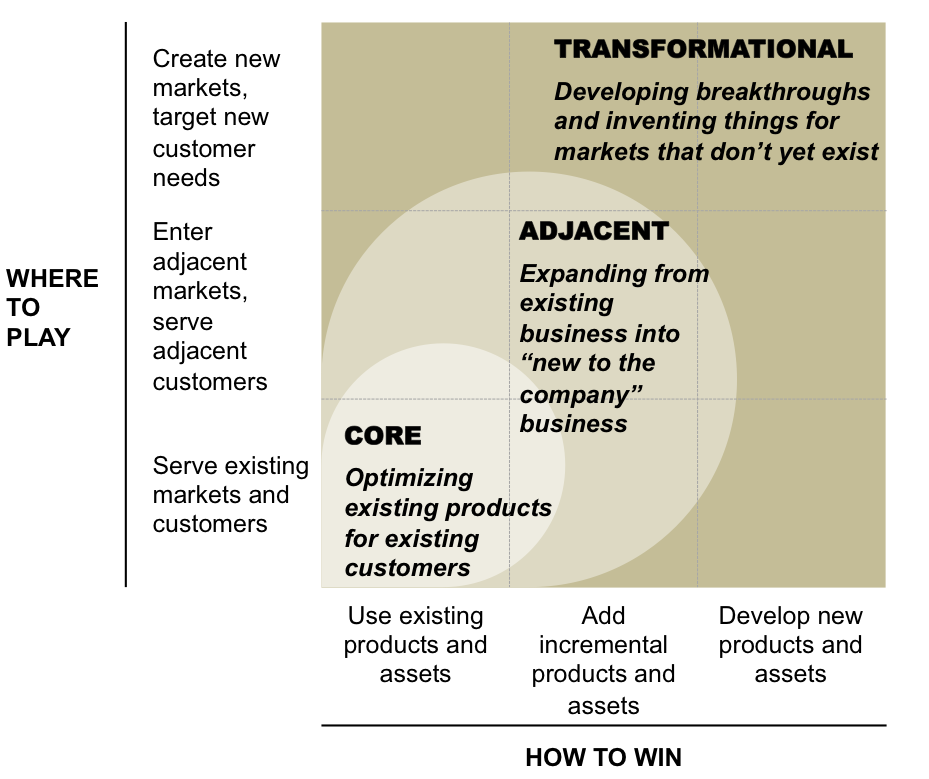

The Innovation Ambition Matrix

An interesting evolution of the Ansoff matrix, the Innovation Ambition Matrix, coined in an article from Harvard Business Review by two recognized consultants, Bansi Magji and Geoff Tuff, entitled ‘Managing Your Innovation Portfolio’. Innovation Ambition Matrix is a simple six-cell model with the vertical axis concerned with where an organisation is competing (ranging from serving existing markets/customers at the bottom, entering adjacent markets in the middle, and creating new markets at the top end of the axis) and the horizontal axis referring to type of products/assets used (using existing products, adding incremental products, and developing new products/assets). The axes of the matrix are labeled as follows: “How to Win.” This is designated for the novelty of the product that you are offering to customers. Are you using existing, adding incremental, or developing new products? “Where to Play.” This measures the novelty of your customers. Will the innovation serve an existing,Continue reading

Capacity Expansion Strategy

Growing an existing business often involves expansion of capacity, in terms of plant, human resources, technological infrastructure, R&D facilities, etc. Any major capacity expansion is a strategic decision that involves significant resource commitments and is often difficult to reverse. So such a decision has to be made carefully. Capacity expansion strategy is often narrowly applied to manufacturing. But in many businesses, there is no or little manufacturing. So, capacity needs to be understood in terms of the investments made in the most critical area of the value chain. Thus, in the pharmaceutical industry, capacity has to be defined in terms of scientific manpower and sales force. In a software development company, capacity has to be understood in terms of the number of programmers employed. In a Business School, capacity may be defined as the number of professors available to teach students. According to Michael Porter, the decision to expand capacityContinue reading

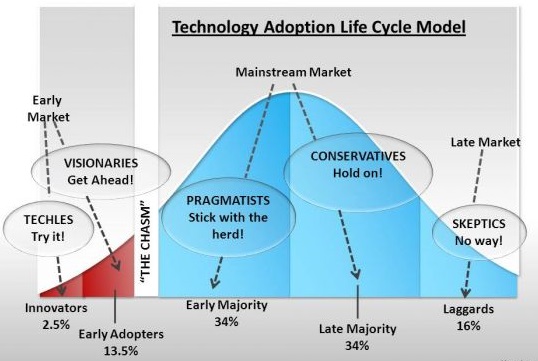

Technology Adoption Life Cycle

Geoffrey Moore, An American organizational theorist, management consultant and author, in his books Crossing the Chasm (1991) and Inside the Tornado (1995), draws on marketing theory and high-tech experience to describe the elements of the product life cycle for technology innovations. His work examines how communities respond to discontinuous innovations – or any new products or services that require the end user in the marketplace to dramatically change their past behavior. He describes how companies must position their products differently through the cycle to reach their full sales potential and become an industry standard instead of a novelty. Many new technologies start along a classic new product diffusion curve, but fail soon thereafter. Through the various phases of the technology adoption life cycle, very different strategies for product and service offering and positioning are called for. The basis of the technology adoption life cycle is similar to theContinue reading

Competitor Analysis

Analyzing competitors is an integral part of strategic planning. Porter’s book, “Competitive Strategy,” gives various insights in Competitor Analysis. In identifying current and potential competitors, firms must consider several important variables: How do other firms define the scope of their market? How similar are the benefits offered by the products and services to those of other firms? How committed are other firms in the industry? What are the long-term intentions and goals of competitors? The goal of competitor analysis is to be able to predict a competitor’s probable future actions, especially those made in response to the actions of the focal business. Competitor analysis has two primary activities, 1) obtaining information about important competitors, and 2) using that information to predict competitor behavior. A competitor analysis should include the more important existing competitors as well as potential competitors such as those firms that might enter the industry. Two complementary approachesContinue reading

Alignment – A Strategic Management Concept By Kaplan & Norton

Alignment is a key factor in effective implementation of strategy. Most large organizations are divided into business units which are out of sync and work at cross purposes. The challenge is to coordinate the activities of these units and leverage their skills for the benefit of the organization as a whole. Kaplan & Norton call this alignment on their book “Alignment: Using the Balanced Scorecard to Create Corporate Synergies.” “Most organizations attempt to create synergy, but in a fragmented, uncoordinated way,” Robert S. Kaplan and David P. Norton. By aligning the activities of its various business and support units, an organization can create additional sources of value in various ways. Financial synergies can be generated through centralized resource allocation and financial management. Value can also be created if corporate headquarters can operate internal capital markets better than external market mechanisms and share knowledge across business units, in a manner thatContinue reading