In many open markets, most goods and services can be purchased from any number of companies, and customers have a tremendous amount of choice. It’s the job of companies in the market to find their competitive edge and meet customers needs better than the next company. So, how, given the high degree of competitiveness among companies in a marketplace, does one company gain competitive advantage over the others? When there are only a finite number of unique products and services out there, how do different organizations sell basically the same things at different prices and with different degrees of success?

This is a classic question that has been asked for generations of business professionals. In 1980, Michael Porter published his seminal book, “Competitive Strategy: Techniques for Analyzing Industries and Competitors”, where he reduced competition down to three classic strategies: Cost leadership, Product differentiation and Market segmentation. These three generic strategies represented the three ways in which an organization could provide its customers with what they wanted at a better price, or more effectively than others. Essentially Porter maintained that companies compete either on price (cost), on perceived value (differentiation), or by focusing on a very specific customer (market segmentation).

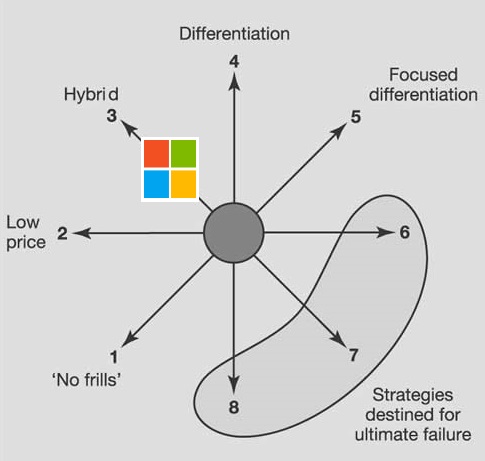

Bowman’s Strategy Clock is a model used in marketing to analyse the competitive position of a company in comparison to the offerings of competitors. It was developed by Cliff Bowman and David Faulkner as an elaboration of the three Porter generic strategies. As with Porter’s Generic Strategies, Bowman considers competitive advantage in relation to cost advantage or differentiation advantage. Bowman’s Strategy Clock represents eight possible strategies in four quadrants defined by the axes of price and perceived added value. The resulting star shape is reminiscent of a clock face, giving this tool its name.

Figure below, represents Bowman’s eight different strategies that are identified by varying levels of price and value.

- Position 1: Low Price/Low Value (No Frill) – Firms do not usually choose to compete in this category. This is the “bargain basement” bin and not a lot of companies want to be in this position. Rather it’s a position they find themselves forced to compete in because their product lacks differentiated value. The only way to “make it” here is through cost effectively selling volume, and by continually attracting new customers. You won’t be winning any customer loyalty contests, but you may be able to sustain yourself as long as you stay one step ahead of the consumer, example Air Asia. No frill goods are inferior but the prices are attractive enough to convince consumers to try them once.

- Position 2: Low Price – Companies competing in this category are the low cost leaders. These are the companies that drive prices down to bare minimums, and they balance very low margins with very high volume. If low cost leaders have large enough volume or strong strategic reasons for their position, they can sustain this approach and become a powerful force in the market. If they don’t, they can trigger price wars that only benefit consumers, as the prices are unsustainable over anything but the shortest of terms. Walmart is a key example of a low price competitor that persuades suppliers to enter the low price arena with the promise of extremely high volumes.

- Position 3: Hybrid (Moderate Price/Moderate Differentiation) – Hybrids are interesting companies. They offer products at a low cost, but offer products with a higher perceived value than those of other low cost competitors. Volume is an issue here but these companies build a reputation of offering fair prices for reasonable goods. Good examples of companies that pursue this strategy are discount department stores. The quality and value is good and the consumer is assured of reasonable prices. This combination builds customer loyalty.

- Position 4: Differentiation – Companies that differentiate offer their customers high perceived-value. To be able to afford to do this they either increase their price and sustain themselves through higher margins, or they keep their prices low and seek greater market share. Branding is important with differentiation strategies as it allows a company to become synonymous with quality as well as a price point. Nike is known for high quality and premium prices; Reebok is also a strong brand but it provides high value with a lower premium.

- Position 5: Focused Differentiation – These are your designer products. High perceived value and high prices. Consumers will buy in this category based on perceived value alone. The product does not necessarily have to have any more real value, but the perception of value is enough to charge very large premiums. Think Gucci, Armani, Rolls Royce. Clothes either cover you or they don’t, and a car either gets you around the block or it doesn’t. If you believe pulling up in your Rolls Royce Silver Shadow is worth 25 times more than in an economy Ford then you will pay the premium. Highly targeted markets and high margins are the ways these companies survive.

- Position 6: Increased Price/Standard Product – Sometimes companies take a gamble and simply increase their prices without any increase to the value side of the equation. When the price increase is accepted, they enjoy higher profitability. When it isn’t, their share of the market plummets, until they make an adjustment to their price or value. This strategy may work in the short term, but it is not a long-term proposition as an unjustified price premium will soon be discovered in a competitive market.

- Position 7: High Price/Low Value – This is classic monopoly pricing, in a market where only one company offers the goods or service. As a monopolist, you don’t have to be concerned about adding value because, if customers need what you offer, they will pay the price you set, period. Fortunately for consumers in a market economy, monopolies do not last very long, if they ever get started, and companies are forced to compete on a more level playing field.

- Position 8: Low Value/Standard Price – Any company that pursues this type of strategy will lose market share. If you have a low value product, the only way you will sell it is on price. You can’t sell day-old bread at fresh prices. Mark it down a few cents, and suddenly you have a viable product. That is the nature of consumer behavior, and you will not get around it, no matter how hard you try.

Positions 6, 7, and 8 of Bowman’s Strategy Clock are not viable competitive strategies in truly competitive marketplaces. Whenever price is greater than perceived value you have an uphill battle on your hands. There will always be competitors offering better quality products at lower prices so you have to have your value and price aligned correctly.

To conclude, Bowman’s Strategy Clock is a very useful model to help you understand how companies compete in the marketplace. By looking at the different combinations of price and perceived value, you can begin to choose a position of competitive advantage that makes sense for you and your organization’s competencies. This is a powerful way of looking at how to establish and sustain a competitive position in a market driven economy. By understanding these eight basic strategic positions of Bowman’s Strategy Clock, you can analyze and evaluate your current strategy and determine if adjustments might improve your overall competitive position.

Short Case Study: Microsoft’s Business Strategy

Price advantage has been effective and consistent with Microsoft’s original goal of enabling PCs that run Microsoft software on every desktop making the use of software is possible for everybody. As Microsoft accessibility vision explains, they even want to make computing an affordable experience for disabled people (Microsoft.com). This explains why Microsoft wanted to offer low prices to its customers. Microsoft success in offering low price user friendly software had result a massive dependent network of individual software users around the world within a very short time span. Ultimately this huge customer base, earn Microsoft the future prospects and economies of scale. In order to cater the various other technological needs which Microsoft does not afford for the moment of this huge customer base, competitors have to rely on Microsoft core technologies to address them. This makes Microsoft the standard platform for every body. On the other hand repetitively both Microsoft customers and their competitors had to stay on Microsoft based technologies provided them no other close alternatives. The huge global Microsoft dependent customer base ultimately thrives to a strategic lock-in in favor of Microsoft. In other terms this platforming helps Microsoft to set standards to the industry while dictating terms to their competitors. Microsoft also offers premium software versions for premium prices for a set of premium customers. That may contribute to departmental sustainability but has less strategic significance as the overall strategy is concerned.

Microsoft was always not the first entrance to the market. But gradually they earn the dominance. As proved above Microsoft intended strategy is focusing on staying low price while providing various means of differentiation. Hence having identified above bases of competitive advantage derived from low price while offering more value through differentiation; Applied Bowman’s strategy clock, this analysis finds that Microsoft business strategy is of Hybrid nature.