In the late 1960s a consultant for the Boston Consulting Group presented his ideas about cash deficient and growth deficient businesses and the need for a balance between cash generators and cash users. After that the Boston Consulting Group developed a portfolio business model based on this thinking. The model, the BCG matrix or growth share matrix, was based on the Boston Consulting Group’s knowledge and work in the area of the experience curve and of the product life cycle and how they relate to cash generation and cash requirements.

The growth share matrix was intended to analyze a portfolio from a corporate perspective because it is only at that level that cash balance is meaningful. A business may, however, be segmented further using this diagnostic tool to understand the positions of its various product lines or market segments. This portfolio can therefore be made up of products in a multi-product company, divisions in a multi-divisional company and companies in a conglomerate.

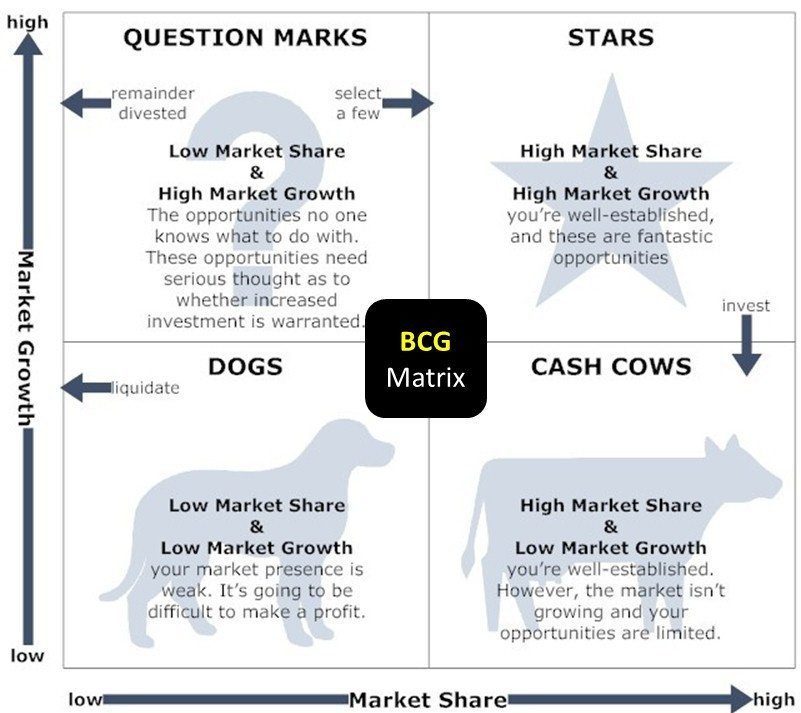

The BCG Growth Share Matrix is based on the observation that a company’s business units can be classified into four categories based on combinations of market growth and market share relative to the largest competitor, hence the name “growth-share”. Market growth serves as a proxy for industry attractiveness, and relative market share serves as a proxy for competitive advantage. The growth-share matrix thus maps the business unit positions within these two important determinants of profitability

The BCG Growth Share Matrix positions the various SBUs/product lines on the basis of Market Growth Rate and Market Share relative to the most important competitor as shown below;

Relative Market Share

This indicates likely cash generation, because the higher the share the more cash will be generated. As a result of ‘economies of scale’ (a basic assumption of the BCG Matrix), it is assumed that these earnings will grow faster the higher the share. The exact measure is the brand’s share relative to its largest competitor. Thus, if the brand had a share of 20 percent, and the largest competitor had the same, the ratio would be 1:1. If the largest competitor had a share of 60 per cent, however, the ratio would be 1:3, implying that the organization’s brand was in a relatively weak position. If the largest competitor only had a share of 5 per cent, the ratio would be 4:1, implying that the brand owned was in a relatively strong position, which might be reflected in profits and cash flows. If this technique is used in practice, this scale is logarithmic, not linear.

The reason for choosing relative market share, rather than just profits, is that it carries more information than just cash flows. It shows where the brand is positioned against its main competitors, and indicates where it might be likely to go in the future. It can also show what type of marketing activities might be expected to be effective.

Relative Market Share = Sales This Year / Leading Rival’s Sales This Year

Market Growth Rate

Rapidly growing brands, in rapidly growing markets, are what organizations strive for; but the penalty is that they are usually net cash users — they require investment. The reason for this is often because the growth is being ‘bought’ by the high investment, in the reasonable expectation that a high market share will eventually turn into a sound investment in future profits. The theory behind the matrix assumes, therefore, that a higher growth rate is indicative of accompanying demands on investment.

Where it can be applied, however, the market growth rate says more about the brand position than just its cash flow. It is a good indicator of that market’s strength, of its future potential (of its ‘maturity’ in terms of the market life-cycle), and also of its attractiveness to future competitors. It can also be used in growth analysis.

Market Growth Rate = (Industry Sales this year — Industry Sales last year) / Industry Sales last year

The BCG Growth Share Matrix

The Boston Consulting Group developed this model for managing a portfolio of different business units (or major product lines). The BCG growth-share matrix displays the various business units on a graph of the market growth rate vs. market share relative to competitors.

This framework assumes that an increase in relative market share will result in an increase in the generation of cash. This assumption often is true because of the experience curve; increased relative market share implies that the firm is moving forward on the experience curve relative to its competitors, thus developing a cost advantage. A second assumption is that a growing market requires investment in assets to increase capacity and therefore results in the consumption of cash. Thus the position of a business on the growth-share matrix provides an indication of its cash generation and its cash consumption.

Resources are allocated to business units according to where they are situated on the grid as follows:

-

- Dog — a business unit that has a small market share in a mature industry. A dog may not require substantial cash because dogs have low market share and a low growth rate and thus neither generate nor consume a large amount of cash, and dogs are cash traps because of the money tied up in a business that has little potential and the capital that could better be deployed elsewhere.

- Question Mark — a business unit that has a small market share in a high growth market. Question marks are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is large net cash consumption. A question mark (also known as a “problem child”) has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

- Star — a business unit that has a large market share in a fast growing industry. Stars generate large amounts of cash because of their strong relative market share, but also consume large amounts of cash because of their high growth rate; therefore the cash in each direction approximately nets out. If a star can maintain its large market share, it will become a cash cow when the market growth rate declines. The portfolio of a diversified company always should have stars that will become the next cash cows and ensure future cash generation. If successful, a star will become a cash cow when its industry matures.

- Cash Cow — a business unit that has a large market share in a mature, slow growing industry. As leaders in a mature market, cash cows exhibit a return on assets that is greater than the market growth rate, and thus generate more cash than they consume. Such business units should be “milked”, extracting the profits and investing as little cash as possible. Cash cows provide the cash required to turn question marks into market leaders, to cover the administrative costs of the company, to fund research and development, to service the corporate debt, and to pay dividends to shareholders. Because the cash cow generates a relatively stable cash flow, its value can be determined with reasonable accuracy by calculating the present value of its cash stream using a discounted cash flow analysis. Cash cows require little investment and generate cash that can be used to invest in other business units.

How to Use BCG Growth Share Matrix?

As for the methods of applying BCG Growth Share Matrix, it can be shown from the following steps: First of all, it is essential to assess the each business’ prospect, which is indicated by growth rate of market. The data of growth rate of market can get from the management analytical system. Evaluating competitive power of each business is the following, relative market share, which could be required from the market survey, has been used to express competitiveness. Subsequently, it is important to mark every business in the BCG Growth Share Matrix. The precise instructions is to draw a circle with the coordinate point of business in two-dimensional coordinates to center, the size of each circle represents the sales. Finally, finding out standard lines of both coordinates is the last and key stage. Making sure the standard line of growth rate of market and relative market share is just to divide the two-dimensional coordinates into four quadrants. And then, the companies can diagnose whether business portfolio is balanced. An unbalanced business portfolio means too many Dogs and Problems, or too few Cash Cows and Stars.

After analyzing the companies’ business, it is constructive to offer some appropriate strategies. There are four methods mentioned: “Build” strategy is coming first, it is appropriate for the Question Marks transforming to the Stars. The product market share should be added to consolidate its competitive power. The next is “Hold” strategy used for Cash Cows so that they can produce sums of cash, whose purpose is to preserve the current market share. Moreover, “Harvest” strategy is used for Question Marks which can not turn into the Stars and for Dogs as well as weak Cash Cows. Here the director just wants to augment short-term cash flows quickly. The last is “Divest” strategy, which is suitable for the Question Marks that can not be the Stars in the future and for the Dogs. At this moment, the managers want to get rid of the products wasting the company’s resource and put the resource into other business where they will acquire greater benefit.