Rolling Settlement process , also known as Compulsory Rolling Settlement (CRS) where trades on a stock exchange were to be accounted for and settled on T i.e. trade day plus “X” trading days, where “X” could be 1,2,3,4 or 5 days. Thus, in essence, it means that if say a T+n, where n is the number of days system of rolling settlement was to be followed, trades accounted for on the T i.e. trade day were to be settled on the nth working day minus the T day.

The Account period of settling transactions was followed in India for a long time. It worked on the idea that transactions for an entire week were to be settled on a pre-specified date the very next week. However, this process was considered too technical and cumbersome. This settlement risk is lowered in Rolling Settlement as the settlement of debts accounting to different working days takes place on entirely separate occasions.

Rolling settlement is the trading system of securities in which the transaction (buying or selling of securities) can be squirred up by a counter-transaction on the same day only. If the transaction is not squirred up on the same day, then the delivery will take place as per the prevailing rules. For example, if an investor purchases a security on Monday and the transaction is not squirred up by a counter-sale transaction, then this buying transaction must be completed. He will get the delivery and he will have to make the payment for the purchase.

The Rolling settlement system was introduced in India on Jan. 10, 2000 when 10 scrip’s were put in the compulsory rolling settlement. Initially, the settlement period was T+5 but it has been gradually reduced toT+2 with effect from April 1, 2003. Since 2000, all other shares have been brought gradually in the compulsory rolling settlement system. It may be noted that there are some shares put in the T-Category. The transactions cannot be squirred up even on the same day in these shares. These are known as “Trade to Trade Shares” and the transaction must end with a delivery and payment.

Before the Rolling Settlement was introduced in year 2000, the normal settlement period was 5 days and it used to take about 15-20 days to get the sale proceeds of the shares. The transaction could be squirred up within the same settlement period also, and in that case, the investor/speculator had to pay or receive the difference only. In order to lessen the period of recovery of sale proceeds from 15-20 days, SEBI formulated the system of Rolling Settlement, or the daily settlement system.

The Rolling settlement system reduces the market risk to a considerable extent. The investors get their money/securities much faster, thus enhancing their liquidity. The wait for the money and the securities is lesser, reducing the cost of funds and the credit risk of the investors. The mutual funds rotate their funds faster and need to keep lesser cash aside, and can manage their cash flows better. In a way, rolling settlement system is a step closer to an efficient delivery and payment system at the stock exchanges.

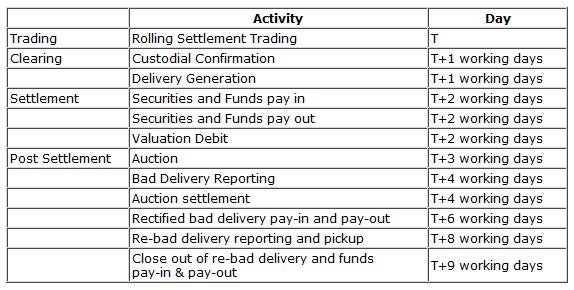

In NSE, the trades pertaining to the rolling settlement are settled on a T+2 day basis where T stands for the trade day. Hence trades executed on a Monday are typically settled on the following Wednesday (considering 2 working days from the trade day). The funds and securities pay-in and pay-out are carried out on T+2 day. An investor has to deliver the securities to the trading member immediately upon getting the contract note for sale but in any case, before the prescribed securities pay-in day. In case of buying, he has to pay the amount to the trading member in such a manner that the amount paid is realised before the funds pay-in day.

The securities and the funds are paid out to the trading member on the pay-out day. The NSE regulations stipulate that the trading member should pay the money or securities to the investor within 48 hours of the pay-out. An investor should instruct the Depository participant (DP) to give ‘Delivery Out’ instructions to transfer the shares from his Beneficiary Account to the Pool Account of trading member through whom he has sold the shares. The details of the Pool A/c of trading member to which the shares are to be transferred, scrip quantity, etc. should be mentioned in the delivery Out instructions. The instructions should be given well before the prescribed securities pay-in day. SEBI requires that the Delivery Out instructions should be given at least 24 hours prior to the cut-off time for the prescribed securities pay-in to avoid any rejection of instructions due to date entry errors, network problems, etc. In case of buying, the trading member will transfer the shares directly to Beneficiary Account of the investor on receipt of the same from the Clearing Corporation.