Average investors are risk averse. Therefore, they will be ready to invest into securities under the presumption of an adequate compensation for risk taking. The compensation for the risk taken should be in the form of minimal rate of return for the invested financial assets, and the rate is named the required rate of return. It has two components:

- Delayed consumption compensation (investors could have purchased goods and services with the assets they are to invest) and

- Risk acceptance compensation.

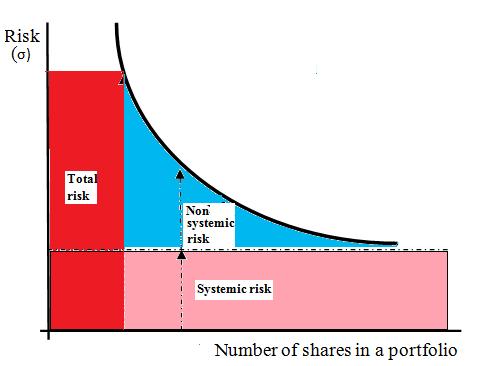

Diversification is used to stabilize the potential return, and thus increase the value of the investment. Diversification stands for he investment of capital into several different securities or projects, all together called the portfolio. Each security or project entails certain risk; however, the only thing that matters to the investors who diversify their investments is the total risk (portfolio risk) and the portfolio return. There are two types of risks associated with portfolio investments:

- Systemic Risk — Risk that can be diversified and

- Non-systemic Risk – Risk that can not be diversified.

It is a known fact that investments with a high level of portfolio diversification have more stable and higher returns in comparison to investments that do not diversify their portfolio. It should be mentioned that investments into securities entail both the systemic and non-systemic risk.

Read More About: Systematic Risk and Non-Systematic Risk in Portfolio Investments

Systemic risk cannot be suspended, i.e. it is always present, and at the securities market it is manifested as the threat of recession, inflation, political turmoil, rise in interest rates etc. Therefore, no matter how much investors may diversify their investments, the systemic risk hazard is always present. The key to protection from non-systemic risk lies in the diversification, and the investor must pay attention to the fact that the security returns are in as little correlation as possible.

By analyzing the above picture the conclusion can be drawn that the increase the number of different shares in the portfolio decreases the non-systemic risk, thereby the total risk as well, while the systemic risk remains unchanged. On the other hand, the total risk can never be completely eliminated.

For example, take an investor who has evenly arranged the investment of his financial assets into 25 shares of different companies from different branches (business activities) in order for the return on securities to be in as little correlation as possible. One of the companies from his/her portfolio reports a poor financial result which causes the company share to plunge by 50 %. It will be assumed that other shares from his/her portfolio that day did not change significantly. Since the investor evenly arranged the investment among 25 companies, the share of each company is 4 %, including the company the value of which fell by 50 %. The investor has lost 2 % of his/her investment.

The above example shows that diversification is desirable; however, when investing, investors face the dilemma of how to diversify their assets, i.e. according to which ratio to invest the total available financial assets into individual securities and/or projects. The answer to the identified problem is given by the Markowitz Portfolio Theory.