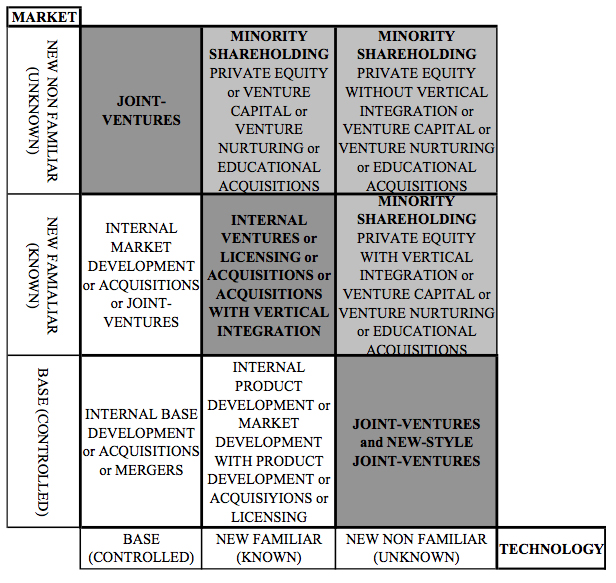

Roberts and Berry devised a technique for selecting optimum diversification action plans for firms wishing to enter new product-markets called the familiarity matrix. It helps strategists decide which product-markets to enter and how. Its two axes, familiarity with market factors and technology or service, are both divided into three values: Base, new familiar, and new unfamiliar. The market dimension refers to the amount of knowledge possessed by the diversifying company of various characteristics of the market and the competitors within it. The authors distinguish between the newness of, and the familiarity with, the market for a product-service. Newness of a market is the extent to which the company has previously targeted it. Markets with which the company has prior experience, conceivably by selling old or existing products in it, are called base markets. Markets with which no such prior exposure exists are called new.

Whether a new product is base or new to the diversifying company, it may or may not be familiar with it. Familiarity is the measure of the degree of understanding the company has of the characteristics and business patterns of the market, even though it may not have participated in it. Thus, a company’s new product choice could represent new but also familiar, new and unfamiliar, or base market factors.

The other dimension of the familiarity matrix, technologies or services embodied in the product, may similarly be base or new. A new technology or service is one which has not been employed in the company’s old or existing products whereas base technologies have been. Familiarity with the technology embodied in the diversification product/service represents the company’s degree of knowledge in it. As with market factors, a diversification product/service can represent a new and familiar, new and unfamiliar, or base technology to the diversifying company.

New business proposals can be placed on the familiarity matrix by locating their position on both the market and technology axes. For both, the possibilities are base, new familiar, or new unfamiliar. Following this procedure a new business product/service would be positioned in one of the nine cells. The three subsets of cells (blank, darkened, and greyed) represent three levels of familiarity the company has with the markets and technology of the proposed new business entry with amount of familiarity.

- Cell #1: Joint ventures — new unfamiliar markets and base technologies. Joint ventures can exploit the competencies of both partners and lead to synergies. They also serve to diversify risk for the partners. In this cell, the company would have had no experience with the market factors in question but would have had vast experience with the technology involved since it would be the base technology of its present business. Thus a joint venture would be a feasible action plan for entering the Cell #1 business as long as the other partner could provide the needed market expertise.

- Cells #2, 3, and 6: Venture capital or nurturing or educational acquisition — new unfamiliar or familiar market or technology. Businesses that fall in any of these three cells would involve both markets and technologies with which the company had either no previous involvement and no knowledge, or some understanding of knowledge with one or the other. Venture capital and nurturing provided by the company to other usually smaller ventures would allow development of experience with a low level of commitment by the company. Venture capital funding alone by the company would be a less involved level of commitment than venture capital with nurturing, the provision of management assistance and support of various kinds along with infusion of funds. The latter would tend to represent a higher level of interest on the part of the company in the new venture than providing venture capital alone. Educational acquisitions are those in which the company acquires the new venture outright and thereby would obtain a faster rate of familiarization with the new venture than would normally be possible with venture capital or nurturing.

- Cell #4: Internal market development, acquisitions, or even joint ventures — new familiar markets; base technology. That the new business involves the company’s base technology in this cell along with familiarization with the markets involved, means that the company may benefit from the internal development of market expertise and of the entire venture. Alternatively, although there would be little technological advantage to relationships with others, the need for market expertise may necessitate acquisition of a venture which had developed a grasp of the market, or even a joint venture with a partner that had this expertise.

- Cell #5: Internal ventures, acquisitions, or licensing — new familiar markets and technology. Businesses which are located in this cell represent markets and technologies with which the company has had no prior experience but with which it has some knowledge and understanding. Therefore with a high level of confidence in this understanding, the company might successfully choose to develop the business internally. With somewhat less confidence, managing an acquisition might be more appropriate. Licensing, as an alternative to outright ownership of a technology, would avoid the risks of developing it internally and could enable the company to acquire market knowledge from the licenser as well.

- Cell #7: Internal base developments — base market factors and technology. Business ventures involving the markets and technologies of a company’s present base businesses would likely be successfully developed internally. Similarly, its experience with both sets of factors could enable it to successfully manage acquisitions involving the new business idea, a more expeditious way of entering the new activity.

- Cell #8: Internal product development, acquisitions, or licensing — base market factors, new familiar technology. When the proposed new venture employs a new technology with which the company has some knowledge, and markets within which it currently competes, internal development of the technology would probably be appropriate. Such a choice would be advisable if the company’s confidence in its understanding of the technology was high. Internal development would allow it to exclusively take advantage of its experience and understanding of market factors. Alternatively, technological expertise could quickly be obtained by acquisition and would be appropriate were time a critical factor. Licensing, too, would be a moderately expeditious action plan but would necessitate sharing of benefits through licensing fees and royalties.

- Cell #9: “New style” joint ventures — base market factors, new unfamiliar technology. The company could bring its base market knowledge and experience to bear on a new venture involving an unfamiliar technology by participating with a small venture that has the appropriate technical expertise. This type of relationship is called a “new style” joint venture and has become an increasingly popular action plan for large, market wise companies wishing to participate in new technologies.