The nature of competition in an industry in large part determines the content of strategy, especially business-level strategy. Based as it is on the fundamental economics of the industry, the very profit potential of an industry is determined by competitive interactions. Where these interactions are intense, profits tend to be whittled away by the activities of competing. Where they are mild and competitors appear docile, profit potential tends to be high. Yet a full understanding of the elements of competition within an industry is easy to overlook and often difficult to comprehend.

Porter’s Competitive Forces Model is one of the most recognized framework for the analysis of business strategy. It is based on the insight that a corporate strategy should meet the opportunities and threats in the organizations external environment. Especially, competitive strategy should base on an understanding of industry structures and the way they change.

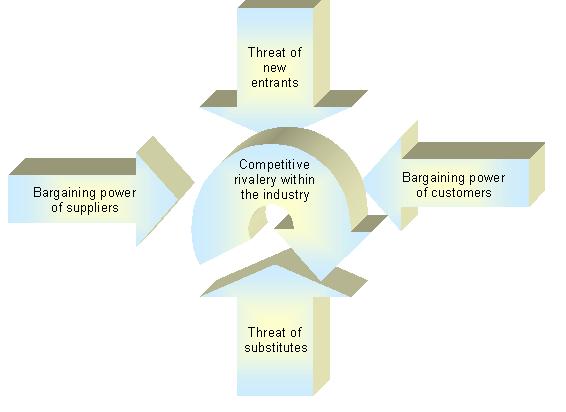

Porter’s Competitive Forces Model – The Five Competitive Forces

The model of the Five Competitive Forces was developed by Michael E. Porter 1980. Since that time it has become an important tool for analyzing an organizations industry structure in strategic processes.

Porter has identified five competitive forces that shape every industry and every market. These forces determine the intensity of competition and hence the profitability and attractiveness of an industry. The objective of corporate strategy should be to modify these competitive forces in a way that improves the position of the organization. Porter’s competitive forces model supports analysis of the driving forces in an industry. The stronger each of these forces is, the more established companies are limited in their ability to raise prices and earn greater profits. A strong competitive force is a threat because it depresses profits. A weak competitive force is an opportunity because it allows the company to earn greater returns. Based on the information derived from the Five Forces Analysis, management can decide how to influence or to exploit particular characteristics of their industry.

The five competitive forces of Porter’s Competitive Forces Model are typically described as follows:

1. Bargaining Power of Suppliers

The term ‘suppliers’ comprises all sources for inputs that are needed in order to provide goods or services. Suppliers are a threat when they are able to force up the price the company must pay for inputs or to reduce the quality of goods supplied. The ability of suppliers to make demands on a company depends on their power relative to that of the company. Supplier bargaining power is likely to be high when:

- The market is dominated by a few large suppliers rather than a fragmented source of supply,

- There are no substitutes for the particular input,

- The suppliers customers are fragmented, so their bargaining power is low,

- The switching costs from one supplier to another are high,

- There is the possibility of the supplier integrating forwards in order to obtain higher prices and margins. This threat is especially high when the buying industry has a higher profitability than the supplying industry,

- Forward integration provides economies of scale for the supplier,

- The buying industry hinders the supplying industry in their development (e.g. reluctance to accept new releases of products),

- The buying industry has low barriers to entry.

In such situations, the buying industry often faces a high pressure on margins from their suppliers. The relationship to powerful suppliers can potentially reduce strategic options for the organization.

2. Bargaining Power of Customers

For an industry, customers can usually be broken into three categories: Consumer, industrial, and commercial customers. Consumers, or purchasers of the firm’s service or product for their own use, are further divided into “bundles” of demographics which collectively identify all the various market segments that are present. Industrial buyers are companies that purchase the firm’s product or service to be used as a component in its product. By contrast, commercial buyers would be other companies that sell firm’s products to consumers.

The bargaining power of customers determines how much customers can impose pressure on margins and volumes. Customers can be viewed as a competitive threat when they force down prices or when they raise expenses by demanding higher quality and better service. The ability of customers to make demands on a company depends on their power relative to that of the company. Customers bargaining power is likely to be high when:

- They buy large volumes, there is a concentration of buyers,

- The supplying industry comprises a large number of small operators

- The supplying industry operates with high fixed costs,

- The product is undifferentiated and can be replaces by substitutes,

- Switching to an alternative product is relatively simple and is not related to high costs,

- Customers have low margins and are price-sensitive,

- Customers could produce the product themselves,

- The product is not strategically important for the customer,

- The customer knows about the production costs of the product,

- There is the possibility for the customer integrating backwards.

An industry’s commercial buyers (retailers) have, in some cases, an additional source of bargaining power over their manufacturing vendors. They can influence customers’ purchase decision. This capability allows retailers to gain price, delivery time, order quantity, and other concessions from their suppliers that other classes of buyers might not receive.

3. Threat of New Entrants

Potential competitors are companies that are currently not competing in the industry but have the capability to do so. New entry into an industry expands supply. This in turn depresses prices and profits. New competitors can reduce the market share of all participants by dividing the “pie” into more pieces. They also may bring new technology or greater resources not available to present competitors and achieve a high market share position quickly to the determent of all existing participants. Thus a high risk of new entry constitutes a strategic threat. A low risk of new entry allows established companies to raise their prices, so it constitutes an opportunity.

The threat of new entries will depend on the extent to which there are barriers to entry. Barriers to entry are the obstacles that a firm must overcome to enter an industry. When high entry barriers exist in an industry, competition is usually less intense and profitability tends to be high. On the other hand, when entry barriers are low, new firms can enter the industry. While demand may not go up immediately, they bring additional capacity along and reduce the overall level of profitability in the industry. The barriers to entry can be tangible or intangible. Tangible barriers include capital, and various kinds of physical assets like plant and machinery and infrastructure. Tangible barriers are easier to replicate than intangible barriers, like brands, corporate reputation, customer loyalty and relationships with vendors/distribution channels. The height of barriers to entry is determined by several factors. These are typically:

- Economies of scale (minimum size requirements for profitable operations),

- High initial investments and fixed costs,

- Cost advantages of existing players due to experience curve effects of operation with fully depreciated assets,

- Brand loyalty of customers,

- Protected intellectual property like patents, licenses etc,

- Scarcity of important resources, e.g. qualified expert staff

- Access to raw materials is controlled by existing players,

- Distribution channels are controlled by existing players,

- Existing players have close customer relations, e.g. from long-term service contracts,

- High switching costs for customers,

- Legislation and government action.

4. Threat of Substitutes

Industries are usually defined in terms of the products or services they provide. However, if we define industries from the buyer’s point of view, we might come up with a quite different set of firms, who deal in different products, but who meet the same type of buyer needs. Substitute products are alternative ways of meeting buyer needs. Substitutes lie outside the traditional industry definition adopted by the firm. They can be viewed in two ways. Substitutes-in-kind are products that look alike and represent the same application of a distinct technology to the provision of a distinct set of customer functions. Substitutes-in-use are products that have shared functionality based on the customer’s perceptions of all the ways in which their needs can be satisfied in a given usage or application situation. The attractiveness of a substitute product depends on its initial price, customer switching costs, post purchase costs of operation and the additional benefits the customer perceives and values.

A threat from substitutes exists if there are alternative products with lower prices of better performance parameters for the same purpose. They could potentially attract a significant proportion of market volume and hence reduce the potential sales volume for existing players. This category also relates to complementary products. The threat of substitutes is determined by factors like:

- Brand loyalty of customers,

- Close customer relationships,

- Switching costs for customers,

- The relative price for performance of substitutes, etc.

Manufacturers of products and suppliers of services must constantly scan their business environments for the potential emergence of substitutes. The most dangerous substitute are those that show potential for improving price-performance trade-offs and those made by firms or industries earning high profits. In these cases, strategies must be formulated to protect against displacement by the substitute product/service.

5. Competitive Rivalry between Existing Players

This force describes the intensity of competition between existing players (companies) in an industry. Strong competition pressurizes on prices, margins, and hence, on profitability for every single company in the industry. Strong rivalry tends to lower prices and raise costs, which constitutes a threat to established companies, whereas weak rivalry creates an opportunity to earn greater returns. Competition between existing players is likely to be high when:

- There are many players of about the same size,

- Players have similar strategies,

- There is not much differentiation between players and their products, etc.

Criticisms of Porter’s Competitive Forces Model

Intel’s former chairman and CEO, Andy Grove, as well as strategy scholars, suggested that the value of the Porter’s five forces model could be further enhanced if one also considers the availability of Complementors, or companies that sell products that are used in addition to and along with the enterprise’s own products. Complementors increase demand for the primary product, thereby enhancing the profit potential for the industry and the firm. When there is a weak supply of complementary products, demand in the industry will be weak, and revenues and profits will be low. The threat from a lack of complementors tends to be greater when:

- Few complementary products exist,

- The existing complementary products are not attractive to customers, due to high prices, inadequate features, and so on.

Porter’s competitive forces model also came under criticism for its lack of consideration regarding the unique resources and capabilities that a firm brings to the industry.

Another criticism is that the five force model is based on the idea of competition. In general, its starting point is that the environment poses a threat to the organization — leading to the consideration of suppliers and buyers as threats that need to be tackled. Porter’s competitive forces model is based on the economic situation in the eighties. This period was characterized by strong competition, cyclical developments and relatively stable market structures. This is hardly the case in today’s dynamic markets. So, this model assumes that companies try to achieve competitive advantages over other players in the markets as well as over suppliers or customers. With this focus, it does not really take into consideration strategies like strategic alliances, technology transfers, virtual enterprise-networks or others. Such strategies may be excluded if they are regarded purely as threats. It also assumes that buyers have no greater importance than any other aspect of the micro-environment.

Some scholars argue that Porter’s competitive forces model emphasizes an outside-in approach and under-emphasizes the importance of the (existing) strengths of the organization (inside-out). That is the main argument behind a competing school of strategy, Resource Based Theory. Notwithstanding this criticism, the Porters five forces model remains a conceptually elegant way of analyzing the structural attractiveness of an industry.